Drew Matus, Senior economist of Lehman Brothers Holdings, says rates could be at 1.25% for a Year. He thinks the Fed might be inclined to pause for now but will have to restart the rate cutting cycle at the end of the year. Bernanke like Greenspan is concerned with asset price deflation, in his firm's opinion, but is in a better position because of a rather high headline inflation rate. Bill Gross in his Investment Outlook argues in a somewhat similar way that home price deflation must be countered "or else the battle might be lost".

Matus sees the April employment number at -90k with the UER holding steady at 5.1.

click for video

video: Drew Matus, Senior economist of Lehman Brothers Holdings, Says Rates Could Be at 1.25% for a Year

Bloomberg

http://www.bloomberg.com/avp/avp.asxx?clip=mms://media2.bloomberg.com/cache/vyTFeWtzW5lQ.asf

read also: Bill Gross' investment outlook for May 2008

http://manonthestreet64.blogspot.com/2008/04/bill-gross-investment-outlook-for-may.html

Wednesday, April 30, 2008

Drew Matus from Lehman Brothers on the Fed, the economy and Friday's NFP

Posted by

Fred

at

11:22 PM

0

comments

![]()

Real GDPa up 0.6 percent AR in the first quarter of 2008

click for video

video: GDP Q1 Report

CNBC

http://cosmos.bcst.yahoo.com/up/player/popup/index.php?cl=7619604

Posted by

Fred

at

11:47 AM

0

comments

![]()

Tuesday, April 29, 2008

Bill Gross' investment outlook for May 2008

Bill Gross in his investment outlook for May 2008, All Quiet on the Western Front, outlines PIMCO's battle plan for investment in this bullet riddled economy. It is important because it sums up the difficulties and challenges that lay ahead for pros and ordinary investors alike. He cites his Co-CIO Mohamed El-Erian, who attributes the recent "euphoric moves" in equity prices and credit market spreads to a natural culmination of the deleveraging process in the financial system and to the restoration of liquidity by "previously unthinkable" policy responses. He agrees with El-Erian that this euphoria might be premature. One possible outcome might be a "Minsky Moment" named after economist Hyman Minsky.

Minsky proposed that speculative investment bubbles are endogenous to financial markets. The bubbles eventually deflate and together make up the normal life cycle of an economy. In 1974 he wrote, "The financial system swings between robustness and fragility and these swings are an integral part of the process that generates business cycles."

Gross and his friends at PIMCO believe that home price deflation has the potential to a Minsky moment and could be ruinous to the economy. "Its deflationary thrust must be countered or else the battle might be lost." If this happens the financial markets could turn down once again instead of up.

Minsky, McCulley, El-Erian, Gross, Feldstein, Summers, and a host of others would likely argue that additional policy measures are required to support home prices which have fallen by 10% over the past 12 months and are set for a repeat by this time in 2009. Lower Fed Funds? They would, in PIMCO’s opinion, likely do more damage than good from this point forward.

The better alternative is to initiate a limited mark-to-market write-down of private mortgage debt as envisioned in the Dodd-Frank Congressional proposal combined with government-subsidized loans at below market rates.

Surely Republicans, Democrats, AND Wall Street mortgage holders (PIMCO included) can recognize that stability as opposed to freefall market clearing is the better alternative, especially if the pain is shared by all parties. It is our best chance to cushion Minsky’s asset-based deflation.

It is somewhat ironical to see how structured financial engineering has been introduced in order to capitalize on the alleged advantage of "sharing the risk", and the failure of this concept at the market place now requires the same financial institutions to share the inflicted pain in order to restore stability. It remains to be seen if the authorities are willing to make the right decisions.

source: All Quiet on the Western Front

Investment Outlook

Bill Gross | May 2008

http://www.pimco.com/LeftNav/Featured+Market+Commentary/IO/2008/IO+May+2008.htm

source: Hyman Minsky

From Wikipedia, the free encyclopedia

http://en.wikipedia.org/wiki/Hyman_Minsky

Posted by

Fred

at

6:54 PM

0

comments

![]()

U.S. foreclosure activity increases 23 percent in first quarter of 2008

U.S. foreclosure activity keeps going higher in the first quarter of 2008. According to RealtyTrac foreclosure filings are up 23 percent over the fourth quarter and a staggering 112 percent higher than first quarter of 2007. In total 649,917 properties were filing for foreclosure in the first three month of this year, one in every 194 U.S. households.

U.S. foreclosure activity keeps going higher in the first quarter of 2008. According to RealtyTrac foreclosure filings are up 23 percent over the fourth quarter and a staggering 112 percent higher than first quarter of 2007. In total 649,917 properties were filing for foreclosure in the first three month of this year, one in every 194 U.S. households.

“Foreclosure activity in the first quarter increased on a year-over-year basis in 46 out of the 50 states and in 90 of the nation’s 100 largest metro areas, demonstrating that most regions of the country are seeing more foreclosures,” said James J. Saccacio, chief executive officer of RealtyTrac.

click to enlarge

This was the seventh consecutive quarter of increasing foreclosure activity and the slightest sliver of improvement gives a reason for hope. Filings in Detroit were down nearly 4 percent from the first quarter of 2007, although the city's foreclosure rate still ranked No. 6 among the nation's 100 largest metropolitan areas. Philadelphia ranked No. 82, thanks in part to a 30 percent year-over-year decrease in foreclosure activity. The Detroit Free Press reports that investors are coming back into the market propping up home sales by 30 percent in March.

Hope Now, the government sponsored enterprise to help loan modifications, saw a 35 percent quarterly jump in foreclosure activity. There were 431,171 subprime 2/28 and 3/27 loans scheduled to reset during the first quarter of 2008 and only 14,418 were modified, while 203,000 loans, about 47 percent of scheduled resets, were paid in full via refinancing or a sale.There was a ratio of 2.4 workouts per foreclosure during the first quarter, below the 3.1:1 ratio recorded in Q4 and the 2.9:1 ratio recorded in Q3.

The dismal state of the U.S. housing market is reflected in the S&P/Case-Shiller Home Price Indices. In February 2008 the 10-City Composite posted a new record low annual decline of 13.6%, and the 20-City Composite recorded an annual decline of 12.7%. “There is no sign of a bottom in the numbers,” says David M. Blitzer, Chairman of the Index Committee at Standard & Poor's. The median home price in the 10 largest metropolitan areas was $190,580, the 20 composite index median home price was $175,940 in February.

click to enlarge

source: U.S. FORECLOSURE ACTIVITY INCREASES 23 PERCENT IN FIRST QUARTER

By RealtyTrac Staff

http://www.realtytrac.com/ContentManagement/pressrelease.aspx?ChannelID=9&ItemID=4566&accnt=64847

source: Steep Declines in Home Prices Continued in February 2008 According to the S&P/Case-Shiller Home Price Indices

http://www2.standardandpoors.com/spf/pdf/index/CS_HomePrice_Release_042952.pdf

source: Servicers Increase Focus on Modifications; Foreclosures Jump 35 Percent in First Quarter

By PAUL JACKSON, HousingWire

http://www.housingwire.com/2008/04/28/servicers-increase-focus-on-modifications-foreclosures-jump-35-percent-in-first-quarter/

read also: Foreclosure filings worse in March 2008

http://manonthestreet64.blogspot.com/2008/04/foreclosure-filings-worse-in-march.html

Posted by

Fred

at

12:52 PM

0

comments

![]()

Monday, April 28, 2008

Fitch downgrades CRE CDO

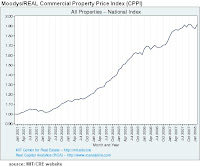

The Massachusetts Institute of Technology publishes 2 types of indexes linked to commercial real estate property values - the commercial property index (CPPI) and the transaction based index (TBI).

The commercial property index is based on the Real Capital Analytics, Inc. (RCA) database which attempts to collect, on a timely basis, price information for every commercial property transaction in the U.S. over $2,500,000 in value. This index is a complementary information product to the TBI also published on the MIT/CRE web site. Both the CPPI and the TBI are based purely on transaction price data. The TBI is based on National Council of Real estate Investment Fiduciaries (NCREIF) property sales prices data. Thus, the TBI is based on a smaller population of more purely institutionally held properties. The TBI is published at the quarterly frequency, and only at the national level, whereas the CPPI includes monthly and annual frequencies and more geographic regional break outs. There is evidence that the CPPI, based on a broader market, tends to lead in time the NCREIF-based indexes.

Latest Results April 22, 2008 update:

The latest results of the Moodys/REAL CPPI show an increase of 2% in February for the all properties national index. (chart shows data only for January)

click to enlarge

click to enlarge

Recently rating agencies like Fitch and Moody's have also started to downgrade CDOs backed by commercial real estate (CMBS). Fitch continues to believe investment grade CMBS will perform well even in a stress environment but remains concerned with lower rated bonds within the structured CMBS transactions.

Fitch took actions on several CRE CDOs:

Fitch downgrades 10 classes of LNR CDO. The CDO has neither paid down nor realized any losses since issuance. Losses are projected with $177.1 million of the loans in the underlying CMBS transactions currently 60 days or more delinquent according to the current trustee report.

Fitch downgrades 15 classes of Ansonia CDO. The collateral has realized $5.1 million in losses to date, which represents 0.6% of the original collateral, with the majority of losses coming from one CMBS transaction. Additional losses are projected with $233.6 million of the loans in the underlying CMBS transactions currently 60 days or more delinquent.

Both CDOs are commercial real estate collateralized debt obligation (CRE CDO) primarily backed by commercial mortgage-backed securities.

source: MIT Center for Real Estate

http://web.mit.edu/cre/research/credl/rca.html

source: Fitch Downgrades 15 Classes of Ansonia CDO 2006-1; off Rating Watch Negative

http://biz.yahoo.com/bw/080425/20080425005843.html?.v=1

Posted by

Fred

at

4:28 PM

0

comments

![]()

REITs outperformed in first quarter 2008

The REITs' performance in the first quarter is particularly impressive, considering their returns this decade. In the past 10 years (ended March), the S&P REIT composite index posted a total return of 4%, vs. the S&P 500's 3.5%. Then, in 2007, as news about a real estate bubble and subprime mortgage problems filled the headlines, REITs fell about 16%.

But in the first quarter of 2008, the group posted a 0.8% total return, at a time when the S&P 500 index fell 9.4%.

source: REITs Show Strength

BusinessWeek

http://www.businessweek.com/investor/content/apr2008/pi20080424_616049.htm?chan=top+news_top+news+index_investing

Posted by

Fred

at

2:55 PM

0

comments

![]()

ARM resets are tame for now

Adjustable rate mortgages (ARM) have been long feared to be the crux of homeowners in the current housing market. Luckily this fears have not come to fruition yet, most likely because of aggressive actions the Federal Reserve has taken since last September. Lowering the target rate has also lowered the rates on several other indexes which are linked to ARMs.

The problem is huge, according to JP Morgan about $500 billion of adjustable-rate mortgage loans are due to reset this year and next.We have looked at ARMs at the beginning of April and noted the positive impact the reduction of the target rate had on ARM rates. The most common ARM type loans are 2-28 and 5-1 with initial rates fixed for 2 and 5 years respectively. The new interest rate is computed by adding a predetermined fixed margin to a selected index rate.

The rates on ARM indexes like LIBOR, CMT, or the Treasury Bill, to name some of the most common ones, have fallen significantly since the Federal Reserve's aggressive rate cuts. Mark Zandi of Economy.com wrote in late February, when the federal rate was at 3 percent:

"If the Federal Reserve had not eased rates, some $250 billion in subprime ARMs would reset higher this year, and nearly $100 billion of those mortgages would see rates jump up at least 2 percentage points. As it is, at the current 3 percent federal funds rate, some $190 billion will reset higher and only $60 billion will undergo more than a 2-percentage point increase."

"If the Federal Reserve quickly cuts the funds rate to 2 percent, as futures markets seem to expect, then $105 billion in mortgages will reset higher and almost no adjustable rates will increase more than 2 points."

But he is also cautious and thinks the problem is big enough to warrant a taxpayer funded bail-out:

"To speed recovery, policymakers should establish a taxpayer-financed fund to buy mortgages and mortgage securities at auction."

As of March 18, payment shocks were only about 1%, S&P said, compared with 19% at the end of December, before the Fed started cutting rates. Since January rates have began to move higher again, but are still within a comfortable range compared to where they would be without central bank help. Here are the latest data on ARM rates:

click to enlarge

source: As ARMs reset, little of the expected chaos is coming to fruition

Kathleen Pender, www.sfgate.com

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2008/04/27/BU7P10BUDM.DTL&feed=rss.business

read also: A Silver Lining - ARMs at same levels 12 month ago

http://manonthestreet64.blogspot.com/2008/04/silver-lining-arms-at-same-levels-12.html

Posted by

Fred

at

1:17 PM

0

comments

![]()

First quarter earnings better than Q4

With 52% of the S&P 500 companies reporting, earnings will likely fall 14.1% vs. a year earlier, according to Thomson Reuters. That follows the fourth quarter's 25.1% plunge and the third's 4.5% slide.

Profits at financials are down 70 percent but are not as bad as feared. Excluding financials, S&P 500 profits should rise 8.6%. Energy firms are on course to deliver 29% growth. Tech profits are rising 9%, easily eclipsing analyst forecasts. Industrial firms' profits are up 6% — 12% excluding GE's (GE) finance-related shortfall.

click to enlarge

source: Profits Plunged In Q1 On Banks, But Better Than Q4

INVESTOR'S BUSINESS DAILY

http://www.investors.com/editorial/IBDArticles.asp?artsec=16&artnum=1&issue=20080425

Posted by

Fred

at

10:29 AM

0

comments

![]()

Friday, April 25, 2008

What credit crisis? - Commercial and Industrial Loans are still growing

The current credit crises claims many victims from CDOs to credit spreads to Libor but commercial and industrial loans are not one of them. According to Federal Reserve Bank of St. Louis loans to cooperations are still growing in a meaningful way. In March 2008 the weekly loan volume change from year ago levels was a record $130 billion. As you can see from the graph (red circles) before the 1990-1991 and 2001 recessions commercial lending activity slowed meaningfully. This suggests that commercial and industrial loan volumes by large commercial banks are not at recessionary levels yet. Loans to consumers are also growing strongly. In March 2008 the weekly loan volume change from year ago levels was also a record $70 billion.

click to enlarge

Not surprisingly real estate loan volume is shrinking since the credit crisis began in July of 2007. Loan volume growth as a change from year ago levels is down peak to trough by $250 billion but has picked up somewhat in March 2008.

click to enlarge

The credit crisis, although showing signs of easing, is still pressuring short term money markets. Various credit spreads are still at stress levels indicating a nervous loan environment among commercial banks.

click to enlarge

source: Release: H.8 Assets and Liabilities of Commercial Banks in the United States

Board of Governors of the Federal Reserve System

http://research.stlouisfed.org/fred2/release?rid=22&soid=1

Posted by

Fred

at

8:20 PM

0

comments

![]()

No recession this year?

Jeffrey Saut, Raymond James chief investment strategist, discusses why he does not feel we are currently headed into a recession.

click for video

video: No Recession this year?

Fox business news

http://cosmos.bcst.yahoo.com/up/player/popup/index.php?cl=7560607

Posted by

Fred

at

7:33 PM

0

comments

![]()

Goldman Sachs's mortgage head quits

HousingWire picks up a story from the WSJ:

The head of Goldman Sachs mortgage department, Dan Sparks, unexpectedly quit on Friday, according to a report in the Wall Street Journal. Along with two key traders, Sparks helped Goldman bet against subprime MBS before the market for subprime paper literally imploded.

The mortgage department of GS, staffed with the real Masters of the Universe, managed to avoid the subprime debacle by selling toxic loans and at the same time shorting them on their own books. Maybe SEC vultures are circling and somebody is getting nervous.

source: Goldman Sachs Mortgage Chief Quits

HousingWire

http://www.housingwire.com/2008/04/25/goldman-sachs-mortgage-chief-quits/

source: The Long and Short of It at Goldman Sachs

By BEN STEIN, NYT

http://www.nytimes.com/2007/12/02/business/02every.html?ex=1354251600&en=cb27663f771ef3d3&ei=5088&partner=rssnyt&emc=rss

Posted by

Fred

at

3:48 PM

0

comments

![]()

Thursday, April 24, 2008

Existing Home Sales plunge in March 2008

The Commerce Department released the data for new home sales in March and the results are disappointing. New single-family homes sales activity fell 8.5 percent last month to a seasonally-adjusted annual rate of 526,000 — a much stronger drop than economists had been expecting. The median price for a new home keeps plunging, down 13.3 percent year-on-year. That is not surprising given the large inventory overhang that is plaguing the housing market since the bursting of the subprime bubble.

New home inventories are actually declining, down 1.1 percent below February's inventory level and nearly 15 percent below a year-ago estimates. There are about 40000 new homes per month available for sale. On the surface that seems good news but considering the slow sales base due to new standards in mortgage origination and securitization the inventory overhang seems more dramatic. An excellent chart from the Calculated Risk blog highlights the dilemma. Inventory levels have now reached recessionary peaks and are close to all time highs.

Despite discouraging news HousingWire sees encouraging trends emerging in existing subprime and Alt-A deals. The secondary mortgage market remains closed with just $7.7 billion in mortgages securitized by private conduits in Q1 2008.

Although delinquencies continued to rise during March across both credit categories and key vintages, roll rates actually declined and cure rates leveled. For those that aren’t familiar, roll rates refer to the percentage of troubled mortgages that move from one delinquency state to another (i.e., 30-day DQs to 60-day DQs); decreasing roll rates, therefore, mean that fewer borrowers transitioned down the default pipeline during March. Cure rates refer to the percentage of troubled loans that were successfully worked out, or cured.

Subprime roll rates declined across all vintages tracked — 2002 through 2007 — while cure rates decreased slightly across all but the 2002 vintage, Clayton said. For Alt-A, in all but the 2005 vintage, first lien roll rates are down between one and three percent month over month, while first lien cure rates rose in all but the 2005 vintage during March.

"Super-bull" Art Nunes gives three - shall we call it - reasons, why he thinks that the housing market is close to recovery:

Supply and demand conditions in the housing market are ripe for recovery. The long term population growth--based on that trendline growth sales should be above 80k homes per month They are about 40k.

Housing inventories are actually shrinking : 8 months for existing home sales

Supply of homes coming to the market has just plummented by over 65% in last two years.

He has one tiny little setback:

"The problem has been lending"

Haynes squeezes "super-bull" Art Nunes

if you must

source: NEW RESIDENTIAL SALES IN MARCH 2008

U.S. Census Bureau

http://www.census.gov/const/newressales.pdf

source: In Battered Secondary Mortgage Market, Some Encouraging Trends May Be Emerging

HousingWire

http://www.housingwire.com/2008/04/24/in-battered-secondary-mortgage-market-some-encouraging-trends-may-be-emerging/

source: Housing Recovery?

There might be a light at the end of the housing tunnel, with Art Nunes, IMS Capital Management; CNBC's Diana Olick & Rick Santelli

http://www.cnbc.com/id/15840232?video=721440230

Posted by

Fred

at

11:09 PM

0

comments

![]()

AXP profit falls 6 percent in the first qarter of 2008

American Express said on Thursday first-quarter profit fell 6 percent as it set aside more money for credit losses, but results beat expectations, and shares rose in after-hours trading. Quarterly revenue climbed 11% to $7.2 billion, in line with analysts' estimates.

American Express said on Thursday first-quarter profit fell 6 percent as it set aside more money for credit losses, but results beat expectations, and shares rose in after-hours trading. Quarterly revenue climbed 11% to $7.2 billion, in line with analysts' estimates.

The company's total provisions for credit losses amounted to $1.27 billion, a 48% increase from the first quarter of 2007.

The writeoff rate in U.S. card services, including both on-balance sheet cardmember loans and off-balance sheet securitized cardmember loans, increased to 5.3% from 3.7% a year ago - faster than the company anticipated.

Chief Financial Officer Daniel Henry expects the loan-loss rate to be higher in the second quarter than in the first quarter.

U.S. card segment revenue jumped 11% to $3.7 billion more than a year ago. Revenue in the international card segment rose 22% to $1.2 billion.

U.S. card services profit fell 19% to $523 million in the first quarter compared with the same period a year earlier, as profit from international card services rose 30% to $133 million.

Posted by

Fred

at

7:36 PM

0

comments

![]()

Euro SSI Flips For The First Time Since 2006

A disappointing German Ifo business climate index and better than expected jobless claims in the U.S. let to a 2 cent decline of the euro against the dollar today. The Federal Reserve is expected to cut another 25 basis points at its meeting next week and according to Greg Ip to hold off any further reductions in the fed funds target rate. Fed funds futures contracts on the Chicago Board of Trade indicated an 82 percent chance the U.S. central bank will lower its 2.25 percent target lending rate by quarter percentage point next week.

From dailyfx.com:

It has finally happened. The EURUSD Speculative Sentiment Index flipped to a net positive reading of 1.14. Encouraged by a sharp yet steady drop in the pair below a major rising trend, this momentous shift in positioning offers the first signs of a major reversal after more than two years of a solid bull trend. With nearly 53% percent of traders holding long positions, this reading is still somewhat weak, but no doubt reflects early profit taking on breakout trades and overrun limit and stop orders.

click to enlarge

In our opinion this is a positioning trade. The SSI signal has to be confirmed in order to make this a real fundamental shift.

source: Fed Weighs Pause After Next Rate Cut

By Greg Ip , WSJ

http://online.wsj.com/article/SB120899756185139975.html?mod=hpp_us_pageone

source: Euro SSI Flips For The First Time Since 2006

dailyfx.com

http://www.dailyfx.com/story/strategy_pieces/fxcm_speculative_sentiment_index/Euro_SSI_Flips_For_The_1209056780285.html

Posted by

Fred

at

2:31 PM

0

comments

![]()

Wednesday, April 23, 2008

Moody's cut some more

This comes from HousingWire:

On Wednesday the agency downgraded another 510 classes from 64 additional subprime deals, according to calculations by Housing Wire, and then got busy cutting up Alt-A securities — to the tune of 388 classes downgraded from 75 different Alt-A deals.

Moody’s also warned of pending downgrades to a stunning 254 different Aaa-rated Alt-A tranches, worth well into the hundreds of billions of dollars.

The list of Alt-A downgrades and Housing Wire’s count of at-risk Aaa tranches are here.

source: Moody’s Downgrades 388 Alt-A RMBS Classes; Warns on 254 Aaa-rated Tranches

HousingWire

http://www.housingwire.com/2008/04/23/moodys-downgrades-388-alt-a-rmbs-classes-warns-on-254-aaa-rated-tranches/

Posted by

Fred

at

11:37 PM

0

comments

![]()

ExxonMobil's R&D spending is 'tiny'

Michael Mandel, chief economist at BusinessWeek, looks into federal and private sector R&D spending on energy. The share of GDP for federal R&D has been steadily falling over time.

The private sector is the real eye-opener:

Take ExxonMobil, which according to its latest annual report "invested $3.5 billion in research and development over the past five years." That sounds like a lot of money--but of course over the same period the company had $90 billion in capital and exploration expenditures, $160 billion in profits, and an absolutely stunning $1.6 trillion in sales. Compared to the size of the company, and the size of the oil markets, ExxonMobil's spending on R&D was tiny. To put it another way, Intel--a much smaller company--spent $26 billion on R&D over the same 5-year period.

source: What About Energy?

Michael Mandel, chief economist at BusinessWeek

http://www.businessweek.com/the_thread/economicsunbound/archives/2008/04/what_about_ener.html

Posted by

Fred

at

10:57 PM

0

comments

![]()

Eurozone Manufacturing Purchasing Manager Index preliminary April 2008

click to enlarge

BTH submits:

BOTTOM LINE: The Eurozone Manufacturing Purchasing Manager Index(PMI), released today, fell to 50.8 in April versus 52.0 in March. This index is at its lowest level since August 2005. Moreover, the Citigroup Eurozone Economic Surprise Index(weighted historical standard deviations of economic data surprises versus the Bloomberg median estimate) has declined from 78.5 on March 26th to a current reading of 19.2. The recent surge in the euro, parabolic rise in commodity prices and the US slowdown are beginning to take their toll on manufacturers in the region. I continue to believe the European Central Bank is falling behind the curve by focusing too much on inflation. I still expect them to change their stance over the coming months, which should boost the US dollar. Manufacturing activity in Europe is clearly slowing, but that is only partially attributed to a strong euro. Industrial New Orders for February are still up 9.9% year-over-year and exports are up 13% year-over-year. In addition the services PMI for the Eurozone increased to 51.8 from 51.6 in March. The argument that a stronger euro hurts the European economy is hardly sustainable. It is more likely that a general slowdown in the U.S. is having some negative impact on Europe and Emerging Markets.

Manufacturing activity in Europe is clearly slowing, but that is only partially attributed to a strong euro. Industrial New Orders for February are still up 9.9% year-over-year and exports are up 13% year-over-year. In addition the services PMI for the Eurozone increased to 51.8 from 51.6 in March. The argument that a stronger euro hurts the European economy is hardly sustainable. It is more likely that a general slowdown in the U.S. is having some negative impact on Europe and Emerging Markets.

click to enlarge

source: Eurozone Manufacturing Purchasing Manager Index Graph

Between the Hedges

http://hedgefundmgr.blogspot.com/

European Services Growth Unexpectedly Accelerated

Bloomberg

http://www.bloomberg.com/apps/news?pid=20601087&refer=home&sid=aUtUlFMuDxTQ

Posted by

Fred

at

9:44 PM

0

comments

![]()

Apple's net income up 36% in second quarter of 2008

Apple posted net income of $1.05 billion, or $1.16 per share, up 36% from a year ago. Sales topped $7.51 billion, up 43% from the same quarter a year ago. In January, Apple predicted second-quarter earnings of 94 cents per share on about $6.8 billion in revenue, compared with 87 cents per share on $5.26 billion revenue in the corresponding quarter a year ago. For its fiscal third-quarter, Apple Chief Financial Officer Peter Oppenheimer said the company expects to earn $1 a share on revenue of $7.2 billion. Analysts had previously forecast Apple to earn $1.09 a share on $7.23 billion in sales.

Apple posted net income of $1.05 billion, or $1.16 per share, up 36% from a year ago. Sales topped $7.51 billion, up 43% from the same quarter a year ago. In January, Apple predicted second-quarter earnings of 94 cents per share on about $6.8 billion in revenue, compared with 87 cents per share on $5.26 billion revenue in the corresponding quarter a year ago. For its fiscal third-quarter, Apple Chief Financial Officer Peter Oppenheimer said the company expects to earn $1 a share on revenue of $7.2 billion. Analysts had previously forecast Apple to earn $1.09 a share on $7.23 billion in sales.

The company said it sold 2.29 million Mac computers in the quarter, topping the 2.04 million to 2.2 million range of five analysts' forecasts.

Apple sold 10.6 million iPods and 1.7 million iPhones in the quarter. Analysts were mostly looking for iPod shipments in the range of 9.5 million to 11 million, and iPhone sales in the 1.4 million to 1.8 million range.

click to enlarge

Posted by

Fred

at

8:26 PM

0

comments

![]()

Why does Merrill need the money?

Bloomberg reports today that Merrill Lynch raised $9.55 billion by selling bonds and preferred shares after writing down the value of $6.5 billion of assets. That's great news for Merryl but Dick Bove, analyst at Punk Ziegel, is not so sure. He contends that CEO John Thain for weeks denied any need of his firm to raise new money. In addition Bove thinks that the company overstated earnings by 2.1 billion dollars due to accounting tricks. Accounting rule 159 led to a write up of Merrill's own debt by 2.1 billion dollars. Bove says its all legal but the company will have to fork over the money in the end when the loans mature. We have refereed to this in a recent post: Are banks unrealized losses 'stashed away' in peculiar accounting?

click for video

video: Dick Bove on banks

http://www.bloomberg.com/avp/avp.asxx?clip=mms://media2.bloomberg.com/cache/vYOaUTAHu1F0.asf

source: Merrill Raises $9.55 Billion in Sales of Debt, Preferred Shares

Bloomberg

http://www.bloomberg.com/apps/news?pid=conewsstory&refer=conews&tkr=MER:US&sid=axqDCKqLjbzA

read also: Are banks unrealized losses 'stashed away' in peculiar accounting?

http://manonthestreet64.blogspot.com/2008/04/stashed-away.html

Posted by

Fred

at

11:37 AM

0

comments

![]()

Tuesday, April 22, 2008

Are AAA-rated bonds the next shoe to drop?

The second half of last year has seen substantial downgrades in RMBS paper. Most of the downgrades were centered around the junior mezzanine and equity positions. A recent report from HousingWire argues that downgrades on the most senior tranches of subprime RMBS mortgage paper have to follow soon. Deutsche Bank estimates that $650 billion on subprime mortgage bonds are yet outstanding, and that 75 percent — or nearly $490 billion — were rated AAA at issuance.

Based on the ratio of credit support to collateral at risk only 6 out of 80 AAA-rated bonds in ABX indexes passed the test for investment grade. The interactive chart below shows in detail which bonds failed and which passed.

click for interactive chart

Moody's investor service is on the case and according to HousingWire has slashed ratings on 1,923 tranches from 232 separate subprime RMBS deals from 2005-2007 vintages, including hundreds of former Aaa-rated securities. The new downgrades portend further earnings pain for the holders of the securities.

The entire list of downgrades issued since Monday morning and through early Tuesday afternoon, along with links to information on each issuer and affected tranche can be seen here.

source: Shell Game: Are Rating Agencies Holding Off on AAA RMBS Downgrades?

HousingWire

http://www.housingwire.com/2008/03/11/shell-game-are-rating-agencies-holding-off-on-aaa-rmbs-downgrades/

source: Stick a Fork in It: Moody’s Downgrades 1,923 Subprime RMBS Classes — In Just Two Days

HousingWire

http://www.housingwire.com/2008/04/22/stick-a-fork-in-it/

Posted by

Fred

at

9:12 PM

0

comments

![]()

Existing home sales down 19.3 percent in March 2008

The National Association of Realtors reports:  In March the annual rate of existing homes for sale seasonally adjusted was down 19.3 percent compared with March of last year. Median home price year-on-year rate declined by 7.7 percent but was slightly higher in March compared to February. Inventories of unsold existing homes was about 1 percent higher in March at 4.06 mln units.

In March the annual rate of existing homes for sale seasonally adjusted was down 19.3 percent compared with March of last year. Median home price year-on-year rate declined by 7.7 percent but was slightly higher in March compared to February. Inventories of unsold existing homes was about 1 percent higher in March at 4.06 mln units.

Market participants saw tentative signs of stabilization and stocks moved higher initially after the release of the numbers. It seems that existing home sales have found a first bottom pulled lower by an initial surge of ARM related foreclosures.

Lawrence Yun, chief economist for the Realtors, expects sales to improve in the second half of this year, helped by an improved availability of mortgage-backed insurance from the Federal Housing Administration and higher limits for jumbo mortgages.

source: Existing-Home Sales Slip in March

NAR, April 22, 2008

http://www.realtor.org/press_room/news_releases/2008/existing_home_sales_slip_in_march.html

source: March Existing Home Sales

http://calculatedrisk.blogspot.com/2008/04/march-existing-home-sales.html

Posted by

Fred

at

12:01 PM

0

comments

![]()

Monday, April 21, 2008

Gartman abandons ship on higher gold price

After three years of a positive outlook for gold Dennis Gartman wrote in his Gartman Letter today:

"The relative strength of the market has been waning since early this year, a circumstance that has bothered us but which we were willing to overlook so long as new highs were being made. It has bounced today, and we shall sell that bounce and exit, entirely.''

Jim Sinclair is not of that wavering sort. He confirms his wager of USD$1,000,000 that gold will hit $1650 on or before the end of the second week in 2011. He believes that the action of the US dollar against the euro will be the "final voice" that determines where the price of gold is going. "There has never been any other driver of gold and there will never be other than the US dollar as the final common denominator." He thinks that 1 euro will eventually be worth 2 dollar. "Right now, right here, the euro is in charge."

Central banks have increased liquidity to stave off tightening conditions in the current credit crisis. M3 money supply is up 20% year over year in the US and global supply has also increased significantly. For Jim Sinclair this can only mean one thing:

"The implication of this is that price inflation follows monetary inflation and therefore we have not even come near the highs that will be posted by hard assets and asset based situations."

click to enlarge

We might eventually be heading this way at least according to Sinclair:

source: Dennis Gartman 'Abandoning Ship' on Higher Gold Price

Bloomberg

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aGIh2dSXFlRk

Where We Stand In The Price Of Gold

Jim Sinclair's MineSet

http://www.jsmineset.com/ARhome.asp?VAfg=1&RQ=EDL,1&AR_T=1&GID=&linkid=6028&T_ARID=6083

read also: Jim Sinclair thinks "This is it"

http://manonthestreet64.blogspot.com/2008/04/jim-sinclair-thinks-this-is-it.html

Posted by

Fred

at

6:27 PM

0

comments

![]()

Are banks unrealized losses 'stashed away' in peculiar accounting?

It is always in times of trouble when hidden truth is being revealed. In the words of Warren Buffett it is "only when the tide goes out that you can see who is swimming naked" (loosely paraphrased). Two reports addressing the same issue but about otherwise different problems have caught my attention.

The Big Picture reflects on a Wall Street Journal article about the outsized losses at Citigroup and Merryl Lynch caused by write downs and credit charges which could have been even worse if not for accounting peculiarities.

Citigroup took $15 billion in write-downs and credit charges, leading the big bank to report a first-quarter loss of $5.1 billion. But $2.3 billion in other write-downs didn't hit the company's income statement.

The same was true at Merrill. The broker had $6.6 billion in write-downs, leading to a loss of $1.9 billion. But Merrill took at least $3.1 billion in other write-downs that didn't count toward its loss."

The market value of securities in the available-for-sale category has to be written down or up depending on the market but all losses or gains are being held in the "other comprehensive income"category. At this point the losses or gains are not part of the income statement.

Financial Accounting Standard No. 159 opens up another back door for the beleaguered financial industry to safe a buck for their reputation. Under this rule the firms can book gains when their debt prices plunge. Freddie Mac has said that adopting the standard boosted capital by $1 billion, or 2.6 percent.

It is feared that rule 159, which is also known as fair value accounting, could result in a misrepresentation of the capital position in GSE's. Ofheo, the GSE regulator, is now considering to prevent the companies from using Fas 159 in situations "where risk management or controls are deficient".

source: Is The Worst of the Credit Crunch Behind Us?

The Big Picture, Barry Ritholtz

http://bigpicture.typepad.com/comments/2008/04/is-the-worst-of.html

source: Fannie, Freddie Regulator Sets `Fair Value' Standards

By Jody Shenn, Bloomberg

http://www.bloomberg.com/apps/news?pid=20602007&sid=a08SlhFsGE8g&refer=rates

Posted by

Fred

at

4:56 PM

0

comments

![]()

New poll finds we are running out of oil

Oil hit a new record high of $117.60 in Nymex trading today and according to the newest Lundberg survey retail gasoline prices jumped 12 cents to a nationwide average of $3.50 per gallon. Gasoline prices are already up 23 percent from a year earlier and the summer driving season is just around the corner. Nymex future prices of a barrel of Wets Texas Intermediate have soared from just under $70 to recent highs in less than 12 month. In 2000 a barrel of WTI cost $20.

Oil hit a new record high of $117.60 in Nymex trading today and according to the newest Lundberg survey retail gasoline prices jumped 12 cents to a nationwide average of $3.50 per gallon. Gasoline prices are already up 23 percent from a year earlier and the summer driving season is just around the corner. Nymex future prices of a barrel of Wets Texas Intermediate have soared from just under $70 to recent highs in less than 12 month. In 2000 a barrel of WTI cost $20.

Prices have continued to climb higher and higher even in the face of declining demand due to a weakening economy. It is hurting profit margins of cooperations who face ever higher input cost but can not raise prices due to competition. The impact on the consumer is felt even more strongly as retail sales are approaching a negative level and consumer confidence is at a record low.

It is therefore not surprising that the oil punditry of all sorts from the pits and news stations alike are sounding the alarm bell and in the course of it pushing oil prices higher. What is surprising though is the fact that now even the public thinks that high oil prices are here to stay and that the world is running out of the precious energy supply. This is a notion, advocated by experts who believe in "peak oil", which argues that production has reached a peak level.

A new WorldPublicOpinion.org poll finds that a majority of 15 in 16 nations surveyed thinks that oil is running out and will reach a new much higher price in the future. The poll was conducted from 14,896 respondents in 16 nations --China, India, the United States, Indonesia, Nigeria, and Russia--as well as Mexico, Britain, France, Azerbaijan, Ukraine, Egypt, Turkey, the Palestinian Territories and South Korea. The nations included represent 58 percent of the world population.

On average, 70 percent of respondents in 15 countries and the Palestinian territories said they thought oil supplies had peaked. Only 22 percent believed enough new oil would be found to keep it a primary fuel source.

On average four out of five (79%) say that oil prices will be higher in the next ten years, including 55 percent who say they will be much higher.

In my opinion polls are like a still photo capturing the mood of the moment and do by no means reflect the truth. Among all this uncertainties one thing is sure: In the face of a declining dollar the price of a barrel of oil will continue to climb.

In my opinion polls are like a still photo capturing the mood of the moment and do by no means reflect the truth. Among all this uncertainties one thing is sure: In the face of a declining dollar the price of a barrel of oil will continue to climb.

source: World Publics Say Oil Needs to Be Replaced as Energy Source WorldPublicOpinion.org http://www.worldpublicopinion.org/pipa/pdf/apr08/WPO_Oil_Apr08_pr.pdf

Posted by

Fred

at

3:31 PM

0

comments

![]()

Friday, April 18, 2008

Caterpillar first quarter 2008 profit jumps 13 percent

CAT had a very good quarter buoyed by strong international sales out of emerging markets. According to CEO James Owens 60 percent of sales are coming from outside the U.S. Owens said the company's order book is healthy with orders for 18 month to 2 years for heavy machineries. He noticed some slowdown in OECD countries but believes that the commodity cycle has a "long way to go".

CAT had a very good quarter buoyed by strong international sales out of emerging markets. According to CEO James Owens 60 percent of sales are coming from outside the U.S. Owens said the company's order book is healthy with orders for 18 month to 2 years for heavy machineries. He noticed some slowdown in OECD countries but believes that the commodity cycle has a "long way to go".

About the price of oil he said:

"Prices north of 45 to 50 dollar (Fri. close @ $116.97) will continue to drive investment. The same for copper with prices of 1.70 to 2 dollar (Fri. close @ 3.893) per pound." (emphasis added)

He thinks that house prices are likely to continue to erode and come down 5 - 10 percent in the next 12 to 18 month.

out of the call ( not part of the video):

Caterpillar now predicts 2008 gross domestic product may rise 0.5 percent in North America, compared with global growth of 3 percent. The company previously projected 1.1 percent economic growth in North America and 3.1 percent worldwide.

Caterpillar said earlier this month it is seeking a price increase of as much as 5 percent on machinery and engines worldwide as costs for materials such as steel, copper and oil rise. Raw material costs have climbed about 1.5 percent a year in the past five years, the company said.

click for video

video: Caterpillar CEO James Owens discusses his company's earnings and outlook with CNBC's Erin Burnett.

http://www.cnbc.com/id/15840232?video=716113236

Posted by

Fred

at

8:34 PM

0

comments

![]()

Google earnings first quarter 2008 - part 2

Google jumped $100 after a sensational beat. Net cash from operating activities was $1.78 billion up from $1.69 billion in the fourth quarter of 2007. Total revenue was$5.19 billion up from $4.83 billion in the fourth quarter. Net cash flow as a percentage of total revenue was stable at 34% (rounded) in the first quarter. Net cash flow as a percentage of advertising revenue was 35% in the first quarter of 2008. There was no breakout of advertising revenue in the fourth quarter of 2007.

Google jumped $100 after a sensational beat. Net cash from operating activities was $1.78 billion up from $1.69 billion in the fourth quarter of 2007. Total revenue was$5.19 billion up from $4.83 billion in the fourth quarter. Net cash flow as a percentage of total revenue was stable at 34% (rounded) in the first quarter. Net cash flow as a percentage of advertising revenue was 35% in the first quarter of 2008. There was no breakout of advertising revenue in the fourth quarter of 2007.

click to enlarge

Posted by

Fred

at

12:53 PM

0

comments

![]()

Thursday, April 17, 2008

Google profit jumps 30% in the first quarter of 2008

Analysts had expected weaker results because industry data from ComScore showed slowing growth in the number of ad-clicks. Google's click growth instead proved to "remain healthy". In addition a feared slowdown in finance-related searches did not curb sales growth either. Both Bear Stearns and Countrywide announced a drop in fourth quarter ad spending between 5 and 10 percent. However, it is worth noting that click growth rate is the lowest since the company began reporting this metric in the fourth quarter of 2006. In last year's first quarter, paid clicks jumped 52% from the previous year -- more than double the growth rate for the recent period. CEO Eric Schmidt brushed off a slowdown in the growth rate saying that the absolute rate has been "very, very significant".

Analysts had expected weaker results because industry data from ComScore showed slowing growth in the number of ad-clicks. Google's click growth instead proved to "remain healthy". In addition a feared slowdown in finance-related searches did not curb sales growth either. Both Bear Stearns and Countrywide announced a drop in fourth quarter ad spending between 5 and 10 percent. However, it is worth noting that click growth rate is the lowest since the company began reporting this metric in the fourth quarter of 2006. In last year's first quarter, paid clicks jumped 52% from the previous year -- more than double the growth rate for the recent period. CEO Eric Schmidt brushed off a slowdown in the growth rate saying that the absolute rate has been "very, very significant".

key stats:

- Net income, including costs from stock options, rose to $1.31 billion, or $4.12 a share, from $1 billion, or $3.18, a year earlier

- Sales excluding revenue passed on to partner sites, up 46 percent from the previous year at $3.7 billion. Revenue grew 65% in last year's first quarter and a whopping 92% in the first quarter of 2005.

- Ad-click growth up 20%, that is down from 52% in the first quarter of 2007 but much higher than the 1.8% expected from ComScore.

- A rise in the value of overseas currencies helped boost international sales by $202 million.

- Google captured 63% of Internet queries worldwide in February, up from 62% in

- For the first time, Google got most of its sales from outside the U.S. December.

- Chief Executive Officer Eric Schmidt said on a conference call Google is seeing "market share growth and good revenue growth in China".

- In its biggest round of job cuts ever, Google fired about 10 percent of DoubleClick's workers this month. The company said it added 2,351 employees in the quarter.

click for video

source: An analysis of Google's Q1 earnings announcements

with CNBC's Jim Goldman

http://www.cnbc.com/id/15840232?video=715054158

read also: Google's paid click growth awful again in March

http://manonthestreet64.blogspot.com/2008/04/googles-paid-click-growth-awful-again.html

Posted by

Fred

at

9:11 PM

0

comments

![]()

Capital One Reports First Quarter Earnings

Credit card company COF reports earnings and allows a peek into the wallets of consumers. Credit performance was largely in line with expectations; but outlook significantly deteriorated due to weakness in the U.S. economy.

Total Company Results

Managed provision expense was $1.8 billion. The company added $310.4 million to its allowance in the first quarter of 2008. This allowance build is consistent with expected managed losses of $6.7 billion over the next 12 months, ending March 31, 2009.

Local Banking Segment highlights

Net charge-off rate of 31 basis points and non-performing loans as a percent of loans held for investment of 56 basis points up from 28 and 41 in the fourth quarter of 2007, respectively.

National Lending Segment

The charge-off rate increased 61 basis points to 5.34% in the first quarter of 2008 from 4.73% in the fourth quarter of 2007.

The delinquency rate of 4.73% in the first quarter of 2008 decreased from 5.17% as of December 31st 2007.

U.S. Card highlights

Charge-offs rose in the first quarter of 2008 to 5.85% from 4.84% in the fourth quarter of 2007, and from 3.72% in the first quarter of 2007. The company expects the charge-off rate to be in the low six percent range for the next six months for the new U.S. Card subsegment, but higher in the fourth quarter.

Delinquencies improved in the first quarter of 2008 to 4.04% from 4.28% in the previous quarter but rose from 3.06% in the year ago quarter.

Auto Finance highlights

Net charge-offs of 3.98% declined slightly from 4.00% in the fourth quarter of 2007, but increased from 2.29% in the first quarter of 2007.

Delinquencies declined 142 basis points from the prior quarter to 6.42% but rose from 4.64% in the year ago quarter.

International highlights

Charge-offs of 5.30% declined 31 basis points from the fourth quarter of 2007, and 74 basis points from the first quarter of 2007.

Delinquencies increased 33 basis points to 5.12 percent from the prior quarter and 34 basis points from the year ago quarter.

Posted by

Fred

at

4:47 PM

0

comments

![]()

ISDA update

Today is the last day of the annual gathering of the ISDA in Vienna. According to Robert Pickel, Chief Executive Officer of the International Swaps and Derivatives Association:

"Credit derivatives, particularly credit-default swaps, have created a vibrant and extremely liquid marketplace for trading and offsetting credit risk. These markets have continued to remain open, providing an outlet, in many cases the only outlet, for firms to continue to manage their risk.''

I don't know on which planet he is living on. "Vibrant" probably relates to the bloated CDS market which is at a new high of $60 trillion. The most provoking commentary comes from Jon Eilbeck, chief operating officer of global rates at Deutsche Bank AG:

"The current crisis will go on through early next year but in the derivatives market I don't see lasting damage. The future's never been brighter and there is light at the end of the tunnel.''

You can't beat that optimism.

Posted by

Fred

at

2:04 PM

0

comments

![]()

Strong dollar policy a "vacuous notion"?

Former Treasury Secretary Paul O'Neill said in a Bloomberg interview today that "The idea of a strong dollar policy is a vacuous notion. It implies in it that somehow we have the ability to manage the relationship between the value of the U.S. dollar and other currencies around the world''.

This is probably the most stupid thing I have ever heard coming from of a government official, albeit in retirement. Of course if that implies that Washington politicians are lying or saying something that they don't mean to say then there is something to it. In other words, if a TS comments on a strong dollar policy this notion has to be backed up by other actions. To support a "strong dollar" and at the same time to tolerate fiscal pillaging and mindless monetary policy is inconsistent to say the least. The proof for this can be easily witnessed in the most recent corporate earnings, where currency adjustments make up for domestic weakness.

KO up19pc/9pc cc

INTC up11pc/>5pc cc

ABT up 14pc/5.5pc cc

.........

This list goes on and on and it shows that authorities fall back to something they can understand - to devalue their way out of trouble.

if you must see - click for video

video: O'Neill Says Strong Dollar Policy Is `Vacuous Notion'

Bloomberg, April 16 2008

http://www.bloomberg.com/avp/avp.htm?clipSRC=mms://media2.bloomberg.com/cache/vwyrSX9

Posted by

Fred

at

11:28 AM

0

comments

![]()

Redbook retail sales jump higher on April 14th week

click to enlarge

Here is what Between the Hedges had to say about the numbers:

BOTTOM LINE: Johnson Redbook weekly retail sales rose 2.0% this week versus a 1.0% gain the prior week and up from a .5% gain the week ending March 4th. This is the largest weekly improvement, notwithstanding unseasonably cold/wet weather, since the week ending July 17th of last year and is the largest weekly rise since the week ending Dec. 4th during the holiday shopping season. While this is only one week and sales still remain modestly below the long-term average of 3.0%, it is a noteworthy improvement. The significant drop in weekly retail sales growth during December was one of the first indications that overall economic growth was slowing substantially.

Posted by

Fred

at

9:52 AM

0

comments

![]()

Wednesday, April 16, 2008

EBay 1Q08 Earnings Up on Weak Dollar, Price Hikes

The effect of translating overseas currencies into dollars boosted quarterly sales by $110 million. U.S. revenue grew 16 percent while international sales grew at twice that rate, at 32 percent.

key stats:

- eBay Inc reported first quarter ended March 31,2008 revenue increase 24% to $2.19 billion on higher listing prices and lower dollar.

- Earnings in the quarter increased 22% to $460 million or 34 cents per share compared to $377 million or 27 cents per share.

- In the quarter the company repurchased 37 million outstanding shares at $1 billion.

- Listings on its marketplaces including EBay.com, Shopping.com, StubHub and Kijiji increased 12% to $16.04 billion with 55% of the net revenue generated outside the U.S.

- PayPal, online payment services reported 32% rise in sales to $582 million. Total payment volume increased 34% to $14.42 billion as active accounts increased 17% to 60.2 million.

- Skype, internet based telephony and chat service increased net revenue by 61% to $126 million with 309 million global registered user base.

- eBay estimates second quarter 2008 net revenues in the range of $2.100 to $2.150 billion

- For the full year the company estimates to generate net revenue between $8.7 billion and $9 billion and earnings per share between $1.35 and $1.40 per share

"We do not believe that we are immune,'' Chief Financial Officer Robert Swan said in a phone interview. "Our sense is that our initiatives are driving the desired benefits, but the underlying economy is slowing.''

Posted by

Fred

at

10:20 PM

0

comments

![]()

IBM Reports 2008 First-Quarter Results

No global slowdown yet! IBM reports a very good first quarter, up 11 percent, adjusted for the weak dollar up 4 percent, still very good. Revenue growth in the U.S. was also strong, up 6 percent after currency adjustment. This is even more so remarkable since IBM shows relative immunity to the troubles in the financial services sector, its largest customer segment.

No global slowdown yet! IBM reports a very good first quarter, up 11 percent, adjusted for the weak dollar up 4 percent, still very good. Revenue growth in the U.S. was also strong, up 6 percent after currency adjustment. This is even more so remarkable since IBM shows relative immunity to the troubles in the financial services sector, its largest customer segment.

key stats:

- Diluted earnings of $1.65 per share, up 36 percent

- Total revenues of $24.5 billion, up 11 percent (4 percent, adjusting for currency)

- Global Technology Services revenues up 17 percent; pre-tax income up 45 percent

- Global Business Services revenues up 17 percent; pre-tax income up 23 percent

- Software revenues up 14 percent; pre-tax income up 22 percent

- 65 percent of revenues from outside the U.S.; E/ME/A revenues up 16 percent; Asia Pacific up 14 percent; U.S. up 6 percent

- Services signings of $10.8 billion at constant currency, that is down 2 percent; $12.6 billion at actual rates

- The company's total gross profit margin was 41.5 percent in the 2008 first quarter compared with 40.2 percent in the 2007 period.

"We feel good about the rest of the year." said Samuel J. Palmisano, IBM chairman, president and chief executive officer.

Posted by

Fred

at

9:24 PM

0

comments

![]()

Its LTCM just bigger - part 2

This is coming out of the International Swaps and Derivatives Association annual conference in Vienna today, and it complements our article from yesterday: Its LTCM just bigger.

"Anything that begins with the letter C, whether it's CDS, CDO or CLO, is being tarnished to some extent,'' said Jonathan Moulds, Bank of America's head of Europe, Middle East, Africa and Asia business. "The industry has been criticized and will continue to be criticized.''

A few interesting facts:

- The market for over-the-couner derivatives - $454.5 trillion

- Credit default swaps outstanding almost doubled last year from $34.5 trillion.

- Problems in OTC derivatives known to the authorities and the industry since 2006, when banks were asked to cut a backlog of 150,000 unconfirmed credit-default swap trades. Greenspan said at the time he found the build up and the industry's practices "unconscionable.''

- At ISDA's conference a year ago, European Central Bank President Jean-Claude Trichet warned of "dangerous herding behavior'' in a market that had become "excessively complacent.''

The pressing question is why are the problems just now surfacing when they were known already since years? It is also interesting to note that the current crisis started with Bear Stearns and reached its climax (for now at least) with Bear Stearns. A possible answer lies way back during the days of the Long Term Capital Management debacle (LTCM). Much like today the New York Fed organized a bail out of a hedge fund that got in trouble because of leverage in derivative contracts. The only bank not participating in the bail out was Bear Stearns.

Thesis:

OTC derivatives market was out of control and this fact was known among industry insiders and authorities. The current crisis was viewed as the last and only chance of breaking the vicious cycle of the shadow banking system of derivatives. Bear Sterns got thrown into the snake pit.

This is a wild idea based on a hunch but interesting nevertheless. The alternative that the subprime mortgage market, as an insignificant part of the general credit market, is able to cause this dislocations is hard to believe either. Of course it is the official version. In any case the severity of the current crisis is real and although the risks are not eliminated yet they are better researched which makes me at least more confident that the industry will weather the storm.

source: Derivatives Face Regulation Amid `Calamitous' Risks

Bloomberg

http://www.bloomberg.com/apps/news?pid=20602093&sid=a.St2jN_zi14&refer=rates

source: Its LTCM just bigger

http://manonthestreet64.blogspot.com/2008/04/its-is-ltcm-just-bigger.html

Posted by

Fred

at

7:43 PM

0

comments

![]()