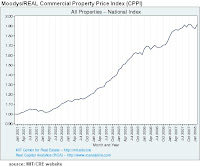

The Massachusetts Institute of Technology publishes 2 types of indexes linked to commercial real estate property values - the commercial property index (CPPI) and the transaction based index (TBI).

The commercial property index is based on the Real Capital Analytics, Inc. (RCA) database which attempts to collect, on a timely basis, price information for every commercial property transaction in the U.S. over $2,500,000 in value. This index is a complementary information product to the TBI also published on the MIT/CRE web site. Both the CPPI and the TBI are based purely on transaction price data. The TBI is based on National Council of Real estate Investment Fiduciaries (NCREIF) property sales prices data. Thus, the TBI is based on a smaller population of more purely institutionally held properties. The TBI is published at the quarterly frequency, and only at the national level, whereas the CPPI includes monthly and annual frequencies and more geographic regional break outs. There is evidence that the CPPI, based on a broader market, tends to lead in time the NCREIF-based indexes.

Latest Results April 22, 2008 update:

The latest results of the Moodys/REAL CPPI show an increase of 2% in February for the all properties national index. (chart shows data only for January)

click to enlarge

click to enlarge

Recently rating agencies like Fitch and Moody's have also started to downgrade CDOs backed by commercial real estate (CMBS). Fitch continues to believe investment grade CMBS will perform well even in a stress environment but remains concerned with lower rated bonds within the structured CMBS transactions.

Fitch took actions on several CRE CDOs:

Fitch downgrades 10 classes of LNR CDO. The CDO has neither paid down nor realized any losses since issuance. Losses are projected with $177.1 million of the loans in the underlying CMBS transactions currently 60 days or more delinquent according to the current trustee report.

Fitch downgrades 15 classes of Ansonia CDO. The collateral has realized $5.1 million in losses to date, which represents 0.6% of the original collateral, with the majority of losses coming from one CMBS transaction. Additional losses are projected with $233.6 million of the loans in the underlying CMBS transactions currently 60 days or more delinquent.

Both CDOs are commercial real estate collateralized debt obligation (CRE CDO) primarily backed by commercial mortgage-backed securities.

source: MIT Center for Real Estate

http://web.mit.edu/cre/research/credl/rca.html

source: Fitch Downgrades 15 Classes of Ansonia CDO 2006-1; off Rating Watch Negative

http://biz.yahoo.com/bw/080425/20080425005843.html?.v=1

Monday, April 28, 2008

Fitch downgrades CRE CDO

Posted by

Fred

at

4:28 PM

![]()

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment