The U.S. economy plagued by the double whammy of a strong downturn in the housing market coupled with substantial stress in financial markets, is at the brink of a severe collapse of aggregate demand. One of the few positive developments during this downturn was strong export growth related to strong global demand. In light of that lifeline emerging market economies (EMEs) represent to the developed economies one can't help but wonder how vulnerable EMEs are to the much anticipated slowdown in the U.S. economy.

By looking at history the experience of the US slowdown in 2001 has shown that the downside risks for EME growth can be substantial. The collapse of the high-tech boom led to a 2 percentage points below average growth in the US, at the same time import growth fell 15 percent below average. Exports in EMEs were hard hit and China suffered a decline in its growth rate of 0.6 percentage points for every 1 percent drop in US growth. However the current episode seems to be different from the experience of the 2001 recession at least thus far. The Bank of International Settlement in his most recent Annual Report, cites mainly two reasons for a possible gradual decoupling of the business cycle in EMEs from the U.S.

from the report:

In contrast, the recent US slowdown appears to date to have been associated with a much smaller decline in EME growth. Indeed, although slowing, EME growth has remained above average (Graph III.12, bottom left-hand panel) as US growth has faltered.

Two explanations can be offered for these differences in growth performance across the two periods. First, in contrast to 2001, emerging market exports continued to grow above their average rates in 2007 (Graph III.12, bottom right-hand panel), even if US import growth was below average. However, as discussed below, the risk of a more severe outcome nonetheless remains. Second, EMEs have recently been able to counter the effects of any fall in demand for their exports by boosting their domestic demand more than in 2001 (Graph III.1, blue circles). Compared to 2001, private consumption spending has risen more strongly in emerging Asia and Latin America. The contribution to growth of investment spending (red circles) switched from negative in 2001 to a strong positive for Asia, Latin America and central Europe in 2007. Thus, there seems to be some growth momentum for domestic demand in most emerging market regions. This may partly explain why, in spite of increasing globalisation, research shows that the impact on EMEs of economic activity in advanced industrial economies has declined.

click to enlarge

The 0-line at the lower half of the chart indicates trend line growth from 1998 to 2007, with the different economies deviating from average annual growth in percentage points. Although growth in nominal exports in EMEs stayed above trend during 2007 exports from China and Latin America have recently turned lower. The consensus forecast of continued growth in EMEs despite a substantial slowdown in US growth has to be taken in with a grain of salt. Forecast usually miss business cycle turning points. Thus, if global developments were to cause a severe downturn in EMEs, it is possible that consensus forecasts would not predict it.

In case that this grain turns out to be more salty than forecast EMEs face three major challenges as the

BIS report lists them:

First, emerging market exports might weaken, possibly more than predicted by recent consensus forecasts. Second, there may be constraints on EMEs’ ability to boost domestic demand to compensate for any weakening in exports. Third, EMEs with high current account deficits and high short-term debt, as well as those that rely heavily on cross-border bank financing, may be vulnerable to reversals of capital flows.

The next graph about China's import developments eases but does not completely dispel such concerns of a severe slowdown in EMEs. Imports for ordinary trade, which is closely related to China's domestic demand, have increased from September 2007 to February 2008. At the same time imports for processing trade, which is directly linked to China's exports, have decreased indicating that at least to some degree domestic demand can make up for a shortfall in external demand. The risk of a slowdown in domestic demand as a result of a marked slowdown in the US economy is highlighted by China's ordinary trade imports which took a steep dive in March. As the chart below demonstrates this slowdown in China's domestic demand is felt all over the globe, in particular in the U.S. and Latin America to a lesser degree in the rest of Asia. Chinese import growth never led to the equivalent growth of exports in its Asian trading partners as compared to the relatively strong growth with Latin America and oil-exporting countries.

click to enlarge

The last chart highlights the vulnerability of EMEs to capital flow reversals. Although EMEs as a whole appear less vulnerable today a severe downturn in the US could test this assumption and prove it wrong. The BIS has identified two types of vulnerabilities and highlights of external vulnerability indicators can be found in the chart below.

Despite some tightening of external financing conditions, the EMEs as a whole – with improved fundamentals, abundant reserves and large current account surpluses – appear to be less vulnerable to reversals in capital flows today than they were in the past. Nevertheless, two types of vulnerabilities to such reversals can be highlighted. First, EMEs with large current account deficits and a high proportion of short-term foreign debt could find it difficult to secure foreign funding if global financing conditions were to tighten more severely. Second, emerging market countries that depend heavily on cross-border bank financing are vulnerable to a withdrawal of such financing due to problems in banks both in advanced industrial economies and at home (see Chapter VII).

Countries that might find it particularly difficult to secure foreign funding if global financing conditions were to tighten further can be identified in the Baltic and southeastern European regions. These countries have very large current account deficits, only around half of which are covered by FDI, usually considered the most stable form of foreign financing (Table III.4). They are also burdened with a high proportion of short-term external debt (120% of foreign exchange reserves on average). Furthermore, cross-border loans in these countries account on average for 76% of domestic credit. South Africa, with a current account deficit of more than 7% of GDP and a high reliance on portfolio inflows, is also in a relatively vulnerable position.

click to enlarge

source: III. Emerging market economies

BIS 78th Annual Report, 30 June 2008

http://www.bis.org/publ/arpdf/ar2008e3.pdf

Monday, June 30, 2008

How vulnerable are EMEs to a slowing US economy?

Posted by

Fred

at

8:27 PM

0

comments

![]()

BIS study reveals fundamental oil lie

The Bank of International Settlements published its 78th Annual Report. In a few paragraphs among its section about Emerging markets economies is a summary of global oil demand growth. Contrary to what the diverse punditry is saying oil demand in China has grown by an average rate of 6.7percent between 2001 and 2007. While this seems fairly large demand for oil was even larger at an 7.6 percent growth rate annually between 1991 and 2000. At the same time demand growth in North America and OECD Europe has contracted from 1.4 to 1.3 and 0.9 to negative 0.2 respectively. Total global oil demand remained relative stable throughout this time period from 1.4 to 1.6 percent growth annually. Moreover global oil stocks have broadly remained stable at about 100 days of forward demand in the last twenty years according to BIS and IEA. Another argument for higher oil prices is spare capacity. It is true that it has declined at the beginning of this decade but it has since risen to about 3 million barrels per day according to OPEC's most recent estimate. Oil has reached a record price of $143 and at the same time it is clear from this study and others that this price spike is hardly based on fundamentals whatsoever.

The Bank of International Settlements published its 78th Annual Report. In a few paragraphs among its section about Emerging markets economies is a summary of global oil demand growth. Contrary to what the diverse punditry is saying oil demand in China has grown by an average rate of 6.7percent between 2001 and 2007. While this seems fairly large demand for oil was even larger at an 7.6 percent growth rate annually between 1991 and 2000. At the same time demand growth in North America and OECD Europe has contracted from 1.4 to 1.3 and 0.9 to negative 0.2 respectively. Total global oil demand remained relative stable throughout this time period from 1.4 to 1.6 percent growth annually. Moreover global oil stocks have broadly remained stable at about 100 days of forward demand in the last twenty years according to BIS and IEA. Another argument for higher oil prices is spare capacity. It is true that it has declined at the beginning of this decade but it has since risen to about 3 million barrels per day according to OPEC's most recent estimate. Oil has reached a record price of $143 and at the same time it is clear from this study and others that this price spike is hardly based on fundamentals whatsoever.

from the report:

Even as demand has grown, supply constraints in some countries have boosted oil prices, despite increases in OPEC supply. According to current investment plans, Saudi Arabian production capacity is projected to increase from 10.5 million barrels per day (mb/d) in 2005 to 12.5 mb/d in 2009. By contrast, non-OPEC oil supply has been held back by the high costs of increasing capacity. For the four largest private sector oil companies outside OPEC, the cost of developing new oil reserves rose by between 45 and 70% over the period 2003–06. The costs of expanding production capacity for these oil companies are much higher than in Saudi Arabia or the United States. Overall spare capacity in the oil industry fell from around 5 mb/d in 2000 to a low of 1 mb/d in 2005, before recovering to 2.2 mb/d in 2007. Research indicates that low spare capacity contributes to higher oil prices. It limits the scope to increase production in order to offset rising demand pressures or disruptions to supply. It also means that larger oil stocks are required to smooth priilce fluctuations. However, global oil stocks have broadly remained stable since the early 1990s (Graph III.5, left-hand panel). The effects on prices have been exacerbated by geopolitical tensions and lower average oil inventories in some major oil-consuming countries.

click to enlarge

source: III. Emerging market economies

BIS 78th Annual Report, 30 June 2008

http://www.bis.org/publ/arpdf/ar2008e3.pdf

Posted by

Fred

at

11:37 AM

0

comments

![]()

Friday, June 27, 2008

Wednesday, June 25, 2008

GDP per inhabitant varied by one to seven across EU27

Based on first preliminary estimates for 2007, Gross Domestic Product (GDP) per inhabitant expressed in Purchasing Power Standards (PPS) varied from 38% to 276% of the average across the EU27 Member States. The figures are based on the latest GDP data for 2007 and the most recent PPPs (purchasing power parity) available. The Purchasing Power Standard (PPS) is an artificial reference currency unit that eliminates price level differences between countries. Thus one PPS buys the same volume of goods and services in all countries. Although there is a level of uncertainty associated with the compiling for PPPs data the large difference in PPS between member states must be of great concern for policy makers in Brussels.

click to enlarge

source: First estimates for 2007

GDP per inhabitant varied by one to seven across the EU27 Member States

Eurostats

http://epp.eurostat.ec.europa.eu/pls/portal/docs/PAGE/PGP_PRD_CAT_PREREL/PGE_CAT_PREREL_YEAR_2008/PGE_CAT_PREREL_YEAR_2008_MONTH_06/2-24062008-EN-AP.PDF

Posted by

Fred

at

1:47 PM

0

comments

![]()

Euro area industrial new orders jump in April 2008

Industrial new orders reversed in April 2008 alleviating concerns of a severe slowdown in the EA economy. While some indicators (PMI composite and business sentiment) point to slower growth ahead the overall picture of sound economic growth in the euro area remains intact.

From the press release:

In April 2008 compared with March 2008, the euro area (EA15) industrial new orders index2 rose by 2.5%. In March3 the index fell by 1.2%. In the EU27 new orders grew by 3.6% in April 2008 after declining by 1.0% in March3. Excluding ships, railway & aerospace equipment4 industrial new orders increased by 2.2% in the euro area and by 1.6% in the EU27.

In April 2008 compared with April 2007, industrial new orders increased by 11.7% in the euro area and by 14.2% in the EU27. Total industry excluding ships, railway & aerospace equipment grew by 11.8% in the euro area and by 12.4% in the EU27.

click to enlarge

source: April 2008 compared with March 2008

Industrial new orders up by 2.5% in euro area

Up by 3.6% in EU27

Eurostat

http://epp.eurostat.ec.europa.eu/pls/portal/docs/PAGE/PGP_PRD_CAT_PREREL/PGE_CAT_PREREL_YEAR_2008/PGE_CAT_PREREL_YEAR_2008_MONTH_06/4-25062008-EN-AP.PDF

Posted by

Fred

at

1:20 PM

0

comments

![]()

Tuesday, June 24, 2008

The rude cause of inflation raises the specter of recession

The first real cracks in the IMC (industrial military complex), the neoconservative power base, are showing up. What is good for one industry is bad for another and Andrew Liveris, chairman and CEO of Dow Chemical, said on Tuesday will raise prices for its products again by as much as 25 percent. This is the second price hike in less than a month. Last month, the company hiked its prices by 20 percent in an effort to offset the steep jump in oil and gas. Liveris also speaks about demand destruction that is occurring in his industry by announcing a cut back on output of some products.

We are idling capacity to cover cash costs. When you can't run the plant to make policy of cash costs you just have to bring it down. Let's call it managing the assets so we don't make negative margins. We are trying to maintain our earnings.

When asked about the future outlook for prices in the industry in the event input costs would come down, Liveris sees $100 oil still as too high for his US and European assets to maintain profit margins. The only alternative in his opinion is to move assets to low cost production countries. With inflation and input costs rising dramatically in those countries as well he might be left with no other choice than permanently keeping production down. This would raise the specter of recession if commodity prices like oil do not correct significantly lower in the next 12 months.

Many of our US and European assets at these sorts of numbers even if you bring oil down to $100 are not reinvestment grade at current input costs.

It is interesting that this view on inflation contrasts with the official outlook of the Fed who thinks that a leveling-out of energy prices at current high levels could bring inflation down by year end. This might very well be a real possible outcome (if we are very very lucky) but it will have little impact on input price pressures that are being felt by the industry and the consumer.

click for video

video: Dow Chemical Raises Prices

Dow Chemical will raise prices by as much as 25% and will implement freigh surcharges, with Andrew Liveris, Dow Chemical CEO

http://www.cnbc.com/id/15840232?video=777149091

Posted by

Fred

at

11:51 AM

0

comments

![]()

IBs in trouble - more layoffs to come?

Bloomberg is out with a report that casts the doom back to investment banks. Here are two quotes from insiders:

"For financial services this is about as bad as I can remember,'' John Challenger, chief executive officer of Chicago- based outplacement firm Challenger, Gray & Christmas Inc., said in a phone interview. "The deal flow is not there. You just don't need as many people.''

"The worst is yet to come,'' Russ Gerson, head of New York- based recruiting firm Gerson Group, said yesterday in an interview. "We are going to have a major contraction. This is affecting all areas of the investment banking universe and it's affecting all areas globally.''

source: Financial Firms May Make Deeper Cuts, Eliminate 175,000 Jobs

Bloomberg

http://www.bloomberg.com/apps/news?pid=20601103&sid=a9D9UjMULF4o&refer=news

Posted by

Fred

at

10:23 AM

0

comments

![]()

Monday, June 23, 2008

Ifo Business Climate for Germany softens in June 2008

From the survey:

The Ifo Business Climate Index for industry and trade in Germany has fallen significantly in June. The firms have assessed their current business situation clearly less favorably than in the previous month, and they are more skeptical regarding the six-month outlook. The sharp hike in oil prices is evidently becoming an increasing burden on the German economy.

In manufacturing the business climate has worsened significantly. The firms have assessed both their current situation as well as the six-month business outlook considerably less favorably than in May. They expect weaker stimulus from export business in the coming months, but despite the strong euro, they do not fear a slump in exports. Increases in employment will be weaker, according to the survey responses.

click to enlarge interesting graphic

source: Ifo Business Climate Germany

Ifo Business Survey

http://www.cesifo-group.de/portal/page/portal/ifoHome/a-winfo/d1index/10indexgsk

Posted by

Fred

at

1:29 PM

0

comments

![]()

Oil summit in Jeddah - pledge for more transparency

British Prime Minister Gordon Brown, after describing the recent surge in oil prices as the third and worst oil shock to hit the world economy in three decades, warns OPEC that Britain will cut demand through a major expansion in renewable power and more conservation.

video: Oil talks: Gordon Brown warns OPEC that Britain will cut demand

By James Kirkup in Jeddah

Last Updated: 1:23PM BST 22/06/2008

http://www.telegraph.co.uk/news/majornews/2174644/Oil-talks-Gordon-Brown-warns-OPEC-that-Britain-will-cut-demand.html

Posted by

Fred

at

12:44 PM

0

comments

![]()

Friday, June 20, 2008

Inflation slumping by year end? - I don't think so

A contrarian outlook The other vision by a bank economist. Bank economists are scared more of deflation than inflation. Why am I not surprised. The doves at the Fed will endorse it.

James Shugg, a senior economist at Westpac Banking Corp., talks with Bloomberg's Jeremy Naylor in London about the outlook for economic growth, inflation and interest rates in the U.S., the U.K. and the euro region. (Source: Bloomberg)

on Fed outlook:

The weaknes in the US economy has not been enough to justify a Fed rate cut. We are certainly not looking for the Fed to hike rates this year and even expect an extended period of 2 percent rates into 2009, ....because of the problems in the banking sector.

click for video

video: Shugg of Westpac Sees U.S., U.K. Inflation `Slumping'

Bloomberg

http://www.bloomberg.com/avp/avp.asxx?clip=mms://media2.bloomberg.com/cache/vxEuFETV98YI.asf&vCat=&RND=489430123

Posted by

Fred

at

12:18 PM

0

comments

![]()

Laughter is the best medicine

I found this video via Barry Ritholtz excellent blog The Big Picture. It dates back to February this year but is so funny and gives a hilarious spin on the economy.

Another must read about government data, shedding light on the economy and conspiracy theories that associate with it, comes also from Barry Ritholtz and can be found here

(What Conspiracy?) .

click for funny video

source: Hot Ladies Talking Money with Bald Dudes

The Big Picture, Barry Ritholtz

http://bigpicture.typepad.com/comments/2008/02/hot-ladies-talk.html

source: What Conspiracy?

The Big Picture, Barry Ritholtz

http://bigpicture.typepad.com/comments/2008/06/conspiracy-theo.html#comments

Posted by

Fred

at

11:34 AM

0

comments

![]()

Thursday, June 19, 2008

Criticizing the central banks balance sheet is easy

but what else is there as lender of last resort.

Grant wrote a brilliant piece, Walter Bagehot Was Wrong, if it only would not be spiked with flaws and political resentment. By reading between the lines I would say he was right with one (not mentioned) observation: It was Trichet who saved the world from financial Armageddon, by early recognizing not to apply the sledge hammer and slash IRs but rather complying with the ECB's role as the lender of last resort. Bernanke only recognized this in the last minute after he had already done damage with interest rates.

To Grant's point:

"A measure of the difficulty of that work is the huge volume of lending that the Bank of England and the ECB, especially, have chosen to undertake; over the past 12 months, the balance sheets of the ECB and the Bank of England have grown by 21% and 19.4%, respectively. (In comparison, the Fed is a model of restraint.)"

This is simply a misleading statement because what matters is not the size of the balance sheet but the quality of assets and liabilities. By comparing the different balance sheets I am assuming that the 21% and 19.4% reflect the amount of ABS paper, for the ECB and the BoE respectively. In its latest Flow of Funds statement (release Z1 from June 2008) the Fed lists under assets $156 billion in bank loans n.e.c (not elsewhere classified, which is another way of saying that these are illiquid assets possibly MBS), for the first time ever on its balance sheet. The size of the Fed's balance sheet is about $900 billion. The $156 billion mark is 17% of the total. This is somewhat lower but don't forget the Fed came late to the action as lender of last resort. In the meantime they have loaned out plenty of government paper in exchange for ABS paper.

We all would prefer Hankey on the helm of all central banks but then we also would need Mellon and Hoover to purge the rottenness out of the system, and we know too well how this game ended.

source: Walter Bagehot Was Wrong

By JAMES GRANT, Grant's Financial Publishing Inc.

http://www.nysun.com/opinion/walter-bagehot-was-wrong/80283/

Posted by

Fred

at

9:00 PM

0

comments

![]()

Cristopher Cox's brave new world

Christopher Cox, chairman of the SEC, writes an op-ed piece in the WSJ, A brave new world for financial regulation, and QaAs on CNBC. He makes some pretty sensational comments as seen below.

on Regulation:

In real time we are working out new stress scenarios that are much tougher we are increasing standards for liquidity and for capital and we are working now, this is very important, very closely with the Federal Reserve.

There needs to be not a copy of the commercial model but at least an analog that has to be applied to IBs. ...IBs are trading firms they are not long term lenders. They need to be nimble and innovative. We lead the world in investment banking services, that's something we don't want to break.

on Cioffi's indictment:

There has probably never been a more obvious connection between alleged wrong-doing and market consequences.

M.B. asks: Are there more people involved? C.C.: Well, not in our complain.

on oil and energy:

Ability to asses proven reserves is an important piece. We want to make sure that we true up oil and gas accounting particularily with respect to reserves.

click for VIDEO

Is that what Cox is saying? (worst case scenario):

Light regulation for IBs

Two scape goat HF managers likely being found guilty

Prospect of significant downgrade in proven oil reserves (bummer!)

video: Regulating Wall Street

SEC Chairman Christopher Cox discusses the need for regulation on Wall Street and the role of his agency.

http://www.cnbc.com/id/15840232?video=774095184

Posted by

Fred

at

6:38 PM

0

comments

![]()

Paulson in search for the ideal regulatory structure of financial markets

Ty secretary Paulson is giving an important speech about the "ideal regulatory structure" in financial markets. He emphasizes the importance to strike the right balance between market oversight and market discipline. In layman's words its difficult/impossible to police the insatiable desire for an easy bug on Wall Street. Though the current credit crisis demands action and some of his suggestions are a step in the right direction: e.g. regulation of the OTC derivatives market and tri-party repo system.

The whole speech is a must read and can been found here.

The following is from Paulson's own summary:

First, we should quickly consider how to most appropriately give the Federal Reserve the authority to access necessary information from complex financial institutions and the authority to act to mitigate systemic risk in advance of a crisis.

Second, we need to take several critical steps to make sure that market discipline continues to play the vital role it needs to play to keep our financial system in balance, as we work to ensure the system's stability. To reduce the perception and the likelihood that a complex financial institution is too interconnected to fail, steps are needed to strengthen our practices and financial infrastructure in the OTC derivatives market and in the tri-party repo system, and to provide greater certainty around the mechanics of winding down a failed institution that is not a federally insured depository institution.

Third, we must re-examine the emergency authorities of the Federal Reserve, Treasury and other financial regulators to ensure they are adequate to the roles they are expected to play in today's modern and multi-faceted financial system.

source: Remarks by Secretary Henry M. Paulson, Jr. on Economy

and Markets before Women in Housing and Finance

http://www.treas.gov/press/releases/hp1040.htm

Posted by

Fred

at

4:32 PM

0

comments

![]()

Wednesday, June 18, 2008

Bair wants FDIC prepared for IB failure

FDIC Chairman Sheila Bair in a speech argues for the implementation of a playbook to deal with a potential failure of a large investment bank. This could be seen similar to what is already a standard protocol for commercial banks. Though Bair insists that the failure of a large bank remains highly unlikely ("I am certainly not predicting one") it is no longer unthinkable.

Should we view the extension as a one-time event or as permanent? In my view, it is almost impossible to go back. As Gary Stern has said, "There is no way to put the genie back in the bottle. Even if we were to announce that we're never going to lend to investment banks again, would that be credible given what we've done?"

If this is the case, it makes sense to extend some form of greater prudential regulation to investment banks as well as a process or protocol for dealing with a systemically significant investment bank approaching failure. The government cannot be put in the position of having to simply write a blank check when these institutions get into trouble.

At a minimum, there should be greater parity between commercial banks and investment banks over how they manage risk, liquidity and capital. There should be a Prompt Corrective Action-like mechanism with mandatory triggers for supervisory intervention and, if necessary, closure if capital is not restored. While many cite Bear Stearns and Northern Rock as liquidity failures, they were both over-leveraged. Greater capital improves access to liquidity.

However, this is not meant as criticism of the Fed. There is a playbook for the failure of a commercial bank, even a systemically important one, but there isn't any for the failure of an investment bank. The Fed had to invent one on the fly. The Fed was in essentially the same boat as the FSA, which had no ready mechanism for handling the failure of Northern Rock. Lack of a playbook was part of the reason the UK had to protect all depositors and nationalize the bank.

source: Remarks by FDIC Chairman Sheila Bair to the Exchequer Club of Washington D.C.

June 18, 2008

http://www.fdic.gov/news/news/speeches/chairman/spjun1808.html

Posted by

Fred

at

10:06 PM

0

comments

![]()

MBIA - another one too big to fail

Bond insurers were front and center in the credit crisis that started in August of last year. In the meantime credit markets have calmed down but today's NYT article by Gretchen Morgenson and Vikas Bajaj reminds us of how frighteningly shaky the financial industry still is. MBIA is in a fight with Eric Dinallo, the commissioner of the New York State insurance department, to recapitalize its muni bond insurance unit with $900 million in cash. While this request/demand is noble MBIA's resistance towards it reveals how desperate the situation for regulators (and eventually for investors) has become.

Besides its muni business the company has guaranteed many other contracts like subprime mortgages and even the financial health of businesses. MBIA has written $137 billion dollar in credit default swaps which insure buyers of such contracts against financial default. In addition buyers get preferential treatment and can demand immediate payment in case MBIA gets into financial trouble (e.g., downgrade by rating agencies).

Eric Dinallo finds himslef in a tight spot, and with him investors in muni bonds and other financial assets, because of MBIA's $137 billion in credit default swaps, which catapults the company into the ranks of BSC and others that are too big to fail.

Mr. Dinallo confirmed last week that the swaps written by MBIA and other financial guarantors were a big factor in his dealings with the weakened bond insurers.

“It is a concern that possibly if one of the companies filed for rehabilitation or if we move to rehabilitate, the holders of the credit default swaps could move to get preferential treatment,” he said.

Mr. Dinallo said he could refuse to honor acceleration demands if he took over a bond insurance firm, but such a move would almost certainly prompt investors who hold the credit default swaps to press their cases in court. The acceleration clause is a standard feature in credit default swaps written by many bond guarantors, including Ambac and the Financial Guaranty Insurance Company.

read on for the full NYT article

source: MBIA Debt Is Setting Up a Quandary

NYT

http://www.nytimes.com/2008/06/18/business/18bond.html

Posted by

Fred

at

4:30 PM

0

comments

![]()

The noose is tightening around oil speculators

Trading Drives Up Oil Prices. Futures trading, largely done beyond the reach of U.S. regulators, is being blamed for driving up the price of oil.

click for very interesting video

video: Oil Trading's Powerful "Dark Markets"

CBS News Looks Inside Futures Trading Beyond Watch Of U.S. Regulators

WASHINGTON, June 17, 2008

http://www.cbsnews.com/sections/i_video/main500251.shtml?id=4188641n

Posted by

Fred

at

2:46 PM

0

comments

![]()

UK tanker drivers receive 14 percent pay rise

BoE governor Mervyn King had to write an embarrassing letter to the chancellor after inflation hit a new high of 3.3. In it King states that he expects inflation to reach 4 percent by year end. Tanker drivers delivering fuel for Shell have been offered a 14% pay increase over two years after their four-day strike hit UK fuel supplies according to Hoyer UK director Bernie Holloway. Authorities are now pleading for moderation in pay negotiations after official inflation numbers exceed income growth in the private and public sector.

According to Chancellor Darling the "above-inflation" pay deal is due to "particular problems" with the tanker driver's union. Without having more detailed information my guess would be that tight resource utilization is behind this deal, and only slack in employment will prevent an inflation spike higher. Contrary to what authorities claim with oil prices at current levels high inflation is already among us.

a prime example of denial:

"Settlements overall over the last 12 months are around 3.5% which is consistent with our inflation target," Mr Darling told the BBC.

Business Secretary John Hutton on BBC:

It is not the job of ministers to set the pay in the private industry.

The deal with the tanker drivers must not become the norm.

We should all exercise common sense and moderation when it comes to pay particularily over the next couple of years

click for video

video: Hutton on pay 'discipline'

BBC

Business Secretary John Hutton has told the BBC that the 14% pay offer for fuel drivers should not set a precedent for other workers.

http://news.bbc.co.uk/1/hi/uk_politics/7462059.stm

source: Fuel drivers offered 14% pay rise

BBC

http://news.bbc.co.uk/1/hi/business/7460452.stm

Posted by

Fred

at

1:26 PM

0

comments

![]()

EA April 2008 preliminary trade surplus: 2.3 bn euro

Eurostat released preliminary data for EU trade balance in April 2008:

The first estimate for the euro area (EA15) trade balance with the rest of the world in April 2008 gave a 2.3 bn euro surplus, compared with +2.0 bn in April 2007. The March 20082 balance was revised up to -1.5 bn from -2.3 bn prior, compared with +7.5 bn in March 2007. In April 2008 compared with March 2008, seasonally adjusted exports rose by 6.2% and imports by 3.6%.

The first estimate for the April 2008 extra-EU27 trade balance was a deficit of 15.4 bn euro, compared with -12.9 bn in April 2007. In March 20082, the balance was -20.8 bn, compared with -10.5 bn in March 2007. In April 2008 compared with March 2008, seasonally adjusted exports rose by 5.1% and imports by 1.4%.

click to enlarge

The strong euro currency does not have the long prognosticated negative impact on euro area trade balance just yet.

NSA data for March 2008 show negative export growth to the U.S. and Japan and flat growth to the U.K. Within member states export growth is negative in the U.K. and Ireland. U.S., U.K. and Ireland are nations where the housing market has rolled over and that seems to reflect on the general economy in these countries with somewhat negative trade data. Spain surprises with healthy export growth of about 5 percent on the month.

EA's trade deficit with China is still high at around 27 bn euro, but slightly lower on a monthly basis.

source: April 2008 Euro area external trade surplus 2.3 bn euro

Eurostat news release http://epp.eurostat.ec.europa.eu/pls/portal/docs/PAGE/PGP_PRD_CAT_PREREL/PGE_CAT_PREREL_YEAR_2008/PGE_CAT_PREREL_YEAR_2008_MONTH_06/6-17062008-EN-AP.PDF

read also: EA March 2008 preliminary trade deficit - 2.3 bn euro

Sunday, May 18, 2008

http://manonthestreet64.blogspot.com/search?q=EA+trade+balance

Posted by

Fred

at

11:38 AM

0

comments

![]()

Tuesday, June 17, 2008

The first nail to the coffin of energy specs

The Commodity Futures Trading Commission said Tuesday it had amended an agreement that would require IntercontinentalExchange's ICE Futures Europe unit to adopt position limits for its West Texas Intermediary crude oil contract that are equivalent to U.S. position limits. ICE said it plans to comply with the amended no-action letter within 120 days, subject to acceptance by the U.K. Financial Services Authority, the regulator of ICE Futures Europe.

source: ICE Futures Europe To Impose U.S. Position Limits

Copyright © 2008 MarketWatch, Inc.

http://www.foxbusiness.com/story/markets/industries/energy/ice-futures-europe-impose-position-limits/

Posted by

Fred

at

12:53 PM

0

comments

![]()

Brian Wesbury to Fed: Take some of the easy money back

Brian Wesbury is sticking to his guns and he has been spot on with his forecast as opposed to the multitude of recessionistas predicting the demise of the US consumer consistently over the last two years. Wesbury is more worried with inflation than he is about growth. He casts the ball back into the corner of the Federal Reserve, which has lowered interest rates too much during this current cycle. The Fed is now in the unfortunate position to take back some of this easing. His point about the Fed and its faulty dual mandate is well taken on this blog site.

"This inflation we are facing today started 2 to 4 years ago. There is at least a lag of 2 yrs between Fed rate cuts and easy money and the resulting inflation."

"The Federal Reserve can't do everything. The Fed should be more like the ECB focus on one target only and focus on inflation."

click for video

video: Economic Data: PPI & Housing

A look at the Producer Price Index and housing starts for Q1, with Scott Nations, Fortress Trading; Brian Wesbury, First Trust Advisors and Jim Tisch, Lowes

http://www.cnbc.com/id/15840232?video=772226719

Posted by

Fred

at

10:36 AM

0

comments

![]()

Monday, June 16, 2008

Foreigners buy Treasuries and Agencies in April TIC data show

Foreign investors bought $80 billion of long-term Treasuries in April, according to TIC data released today. China bought $31.5b of long-term debt, while reducing its short-term holdings by $2.7b. That works out to $28.8b in net purchases. Brad Setser in his excellent blog argues:

The funny thing is that this almost certainly understates China’s true purchases of US debt. In the past few years, about ½ of the Treasuries purchased by the UK have been reallocated to China in the annual survey (see the June revisions to this series). We know that China’s reserves increased by about $80 billion (after adjusting for valuation gains) in April, so it is realistic to think that China’s true purchases of US assets were closer to $60 billion than $30 billion.

This excellent chart comes from Brad Setser's Blog

Noooo flight from US$ denominated assets just yet!

source: The April TIC data lends itself to a host of different headlines …

Brad Setser's Blog: Follow the Money

http://blogs.cfr.org/setser/2008/06/16/the-april-tic-data-lends-itself-to-a-host-of-different-headlines-%e2%80%a6/

Posted by

Fred

at

9:44 PM

0

comments

![]()

Friday, June 13, 2008

Gary Shilling still concerned about deflation

Gary Shilling, Pres. of A. Gary Shilling & Co., shares his thoughts about a possible US recession, the US dollar and China in a Bloomberg interview. He was early and spot on in predicting a decline in the US housing market. His thoughts are always pristine and consistent and have therefore excellent forecasting value. Let's just hope he is wrong.

Gary Shilling thinks that the UER in the US will peak at 7.2 percent in the second quarter of 2009. That will mark the bottom of the recession. He does not agree with Bernanke and thinks recession is the concern and not inflation.

Shilling looks for "biggest decline in consumer spending since the 1930", a decline of 2.5 percent in inflation adjusted consumer spending. The Fed would then be forced to ease again.

Gary Shilling sees opportunity to buy the short end of the Treasury in the futures market because he does not think the Fed will actually raise rates. By the end of the year he is more worried about deflation and not inflation.

He is also long the dollar against the euro. As this recession spreads globally he believes that there will be a run on the dollar as a save haven.

Shilling sees no decoupling of China from the US. He argues that China does not have a strong enough middle class to sustain their economic growth, and only 8 percent of the population has meaningful income to sustain discretionary spending.

click for video

video: Shilling Sees `Big Nose Dive' in Consumer Spending

Bloomberg

http://ads.bloomberg.com/adstream_sx.ads/bloomberg/tvradio/tv/vod/av/1194908440@x70,Middle!Middle

Posted by

Fred

at

11:27 AM

0

comments

![]()

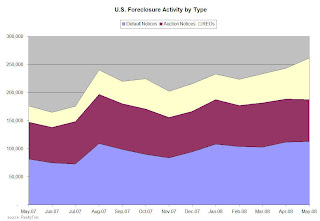

US foreclosure filings surge 48 percent in May 2008

Foreclosure filings are up 7% from April and 38% from May last year. Nationwide, 261,255 homes received at least one foreclosure-related filing in May 2008. Nearly 74,000 properties were repossessed by lenders nationwide in May, while more than 58,000 received default notices, RealtyTrac said.

Here is the press release from RealtyTrac:

Foreclosure activity continued its upward climb in May, increasing on a year-over-year basis for the 29th consecutive month, according to the RealtyTrac U.S. Foreclosure Market Report released today. The report showed one in every 483 U.S. households received a foreclosure filing during the month, the highest monthly foreclosure rate since RealtyTrac began issuing its report in January 2005.

Bank repossessions (REOs) accounted for 28 percent of the total activity and the biggest increase among the three types of foreclosure filings tracked in the report. REOs were up 35 percent from the previous month and 158 percent from May 2007. Default notices increased 1 percent from the previous month and were up 35 percent year over year, while auction notices decreased 3 percent from the previous month but were still up 13 percent year over year.

click to enlarge

source: Foreclosure Downpour Continues in May

RealtyTrac

http://www.foreclosurepulse.com/archive/2008/06/11/45351.aspx

read also: US foreclosure filings surge 65% in April 2008

Wednesday, May 14, 2008

http://manonthestreet64.blogspot.com/search?q=RealtyTrac

Posted by

Fred

at

8:12 AM

0

comments

![]()

Thursday, June 12, 2008

Sen. Lieberman wants to regulate commodities trading

Michael Greenberger, a former CFTC official, comments on Lieberman's plan:

"Specultors can come in but they cannot dominate the market.... In the WTI (NYMEX + ICE) market it will be 80% speculators and 20% commercials, usually it is exactly the revers. The speculators are in control. Lieberman has a plan to not bar them but bring them within realism and keep this markets more to economic fundamentals."

click for video

video: Speculator Crackdown

Debating whether there should be a crackdown on commodities trading, with Gavin Maguire, of the Iowa Grain Company, and Michael Greenberger, U. of Maryland law professor

http://www.cnbc.com/id/15840232?video=769244114

read also: Another day another hearing

Wednesday, June 4, 2008

http://manonthestreet64.blogspot.com/2008/06/another-day-another-hearing.html

Posted by

Fred

at

3:29 PM

0

comments

![]()

OCC annual underwriting survey reveals tightening credit standards

The Office of the Comptroller of the Currency (OCC) conducted its 14th annual underwriting survey to identify trends in lending standards and credit risk for the most common types of commercial and retail credit offered by national banks. The survey covered the 12-month period ending March 31, 2008.

Commercial underwriting trends:

For overall commercial credit 52% tightened underwriting trends.

60% tightening underwriting in leveraged loans, 22% in asset backed loans, CRE commercial, CRE residential and Credit exposure to HF tightened substantially.

Economic outlook for 92% of banks the reason for tighter credit, for 52% it is risk appetite.

72% expect increase in commercial credit risk trends in the next 12 months.

Current credit risk trends increased significantly for all product types surveyed (except for agricultural loans and commercial leasing risk trends increased less than 50%).

Retail underwriting trends:

For overall retail credit 68% tightened underwriting trends.

52% tightened underwriting for HELOC conventional, 89% HELOC high LTV and 56% for real estate.

Economic outlook for 82%, risk appetite for 60% and product performance for 60% of banks the reason for tighter credit.

67% expect increase in retail credit risk trends in the next 12 months.

All product types, except affordable housing and other direct consumer, saw a significant increase in risk trends. All the banks surveyed (100%) reported increased current risk trends in HELOC high LTV.

No surprises in the survey. Economic Outlook is the most important determinant in the availability of credit both to commercial and retail customers. HELOCs are not available for borrowers with low equity in their collateral. Most banks originate new loans to hold only (81% commercial and 69% retail).

click to enlarge

source: Survey of Credit Underwriting Practices 2008

Office of the Comptroller of the Currency June 2008

http://www.occ.treas.gov/cusurvey/2008UnderwritingSurvey.pdf

read also: European bank lending worse in first quarter 2008

Friday, May 9, 2008

http://manonthestreet64.blogspot.com/2008/05/ezb-reports-worse-credit-conditions-in.html

read also: Fed reports banks tightened credit in first quarter of 2008

Monday, May 5, 2008

http://manonthestreet64.blogspot.com/2008/05/fed-reports-banks-tightened-credit-oin.html

Posted by

Fred

at

12:54 PM

0

comments

![]()

Wednesday, June 11, 2008

OCC sees mortgage portfolio of major banks 'relatively stable'

According to a new study of the Office of the Comptroller of the Currency the overall mortgage portfolio of the nine larges US banks surveyed is "relatively satisfactory and stable". 62 percent of all mortgages were prime and only 9 percent of the total portfolio was subprime. This means that the nine banks in the survey are holding about $350 billion in subprime mortgages. Makes one wonder where are the other $900 billion.

The biggest U.S. banks that service more than 23 million mortgages totaling $3.8 trillion have focused on setting up repayment plans for troubled borrowers rather than modifying their loans, a top U.S. banking regulator said on Wednesday.

"Payment plans predominated, outnumbering loan modifications in March by more than four to one," said John Dugan, head of the U.S. Office of the Comptroller of the Currency.

The nine banks participating in the OCC study are Bank of America, Citibank, First Horizon, HSBC, JPMorgan Chase, National City, USBank, Wachovia and Wells Fargo.

source: U.S. banks opt for payment plans for ailing mortgages

Reuters, Wed Jun 11, 2008 2:34pm EDT

http://www.reuters.com/article/businessNews/idUSN1117997920080611?feedType=RSS&feedName=businessNews

Posted by

Fred

at

4:06 PM

0

comments

![]()

Kohn - a bit of additional price inflation and a bit of additional unemployment

Federal Reserve Vice-Chair Kohn is surprised by the persistent jump in the price of oil and suggests a Taylor rule trade off between employment and inflation. This includes both higher inflation and higher unemployment in an attempt to adjust wages and prices. Kohn seems to have asked himself what to do squeezed between a rock and a hard place. Answer: Find the most comfortable position possible to wait out the wild ride ahead.

"Since real wages need to fall and both prices and wages adjust slowly, the efficient adjustment of relative prices will tend to include a bit of additional price inflation and a bit of additional unemployment for a time, leading to increases in real wages that are temporarily below the trend established by productivity gains."

We need new ideas and new people at the helm of the Federal Reserve!

source: Lessons for Central Bankers from a Phillips Curve Framework

Vice Chairman Donald L. Kohn

At the Federal Reserve Bank of Boston's 52nd Annual Economic Conference, Chatham, Massachusetts

June 11, 2008

http://www.federalreserve.gov/newsevents/speech/Kohn20080611a.htm

Posted by

Fred

at

2:54 PM

0

comments

![]()

Friday, June 6, 2008

NFP down 49k in May 2008

Jobs Preview

Measuring the expectations, with Scott Nations, Fortress Trading; Diane Swonk, Mesirow Financial; Mark Zandi, Economy.com; CNBC's Steve Liesman & Rick Santelli

Liesman: Labor hording, as downturns happens employers are always reluctant to fire. The job market is relatively lousy.

Zandi: Final revisions will show that we probably lost lot more jobs than we think. Its probably not as bad as last recession.

Nations: If we get a decent number the Fed may raise rates sooner rather than later

interesting discussion between Santelli and former Fed official Bob McTeer about the fed and the ECB and yesterdays comments from JCT

click for video

Employees on nonfarm payrolls by detailed industry not seasonally adjusted:

Employees on nonfarm payrolls by detailed industry not seasonally adjusted:

Real estate credit and credit intermediation substantial job losses in March and April compared to last year (May data not available at this point). Overall financial activities gained about 20k jobs in May from last month. Commercial baking was flat in May from last moth.

Educational and health services are down 34k in May from alst month but up 566k from last year. Most of the gains were in health care, educational services shed 94k from last month but are up significantly from last year.

Government with slight increase in employment over the month.

State governments are down 104k in the month, with most of the losses in education.

Local governments created 109k!! new jobs, with about a third of the increase in education. The increase in Local government jobs is surprising given the fiscal challenges that most local governments are facing in the current economic downturn.

The Diffusion index for private non farm payrolls over the last twelve month was at 47.8 in May. This is the first time since the 2001 recession that more companies are laying off than hiring workers over a twelve month time span. This reflects the marked increase in weekly continuing claims numbers. The index over 1,3 and 6 month time span is not at the trough levels of the last recession.

click to enlarge

more stats:

video: Jobs Preview

CNBC

http://www.cnbc.com/id/15840232?video=763452577

source: THE EMPLOYMENT SITUATION: MAY 2008

BLS

http://www.bls.gov/news.release/pdf/empsit.pdf

source: B-12. Employees on nonfarm payrolls by detailed industry

BLS

ftp://ftp.bls.gov/pub/suppl/empsit.ceseeb12.txt

read also: NFP declined by 20k in April 2008

Friday, May 2, 2008

http://manonthestreet64.blogspot.com/2008/05/nfp-declined-by-20k-in-april-2008.html

Posted by

Fred

at

5:18 PM

0

comments

![]()

Thursday, June 5, 2008

Wachovia forecasts CRE slump

This chart comes from the excellent Calculated Risk blog and shows the dire forecast for commercial real estate.

This Non-Residential Investment overview, with excellent charts, comes from CalculatedRisk.

source: Non-Residential Investment Overview

by CalculatedRisk, Tuesday, May 13, 2008

http://calculatedrisk.blogspot.com/2007/05/cre-overview.html

read also: March 2008 CPPI down 2.3 percent according to Moody's

Monday, June 2, 2008

http://manonthestreet64.blogspot.com/2008/06/march-2008-cppi-down-23-percent.html

Posted by

Fred

at

10:08 PM

0

comments

![]()

Significant insights into the flow of fed funds - implications from the credit crisis

Borrowing/lending at state and local governments has significantly decreased in the last three quarters, since the start of the credit crisis in August of last year. According to flow of fed funds both borrowing and lending have increased at the federal level. The impact of the credit crisis has been felt more at state and local government level rather than the federal government. The crisis in the auction-rate bond market for municipalities is just one example of how the problems in subprime mortgages reverberated throughout different markets.

ABS also saw a significant reduction in the flow of fed funds with borrowing and lending net negative in the last two quarters. This is probably the result of the breakdown in the securitization market.

Borrowing/lending to households was significantly impaired in the first quarter of 2008, mainly reflecting the troubles in the residential mortgage market.

Money market mutual funds saw a three fold increase in net lending reflecting an inflow of liquidity in a flight to quality.

Form 108 (monetary authority) summarizes assets and liabilities of Federal Reserve Banks and Treasury monetary accounts that supply (green circles) or absorb (red circles) bank reserves:

Treasury securities saw significant outflows since the third quarter with a decrease of a stunning $590 billion in the first quarter of 2008. Federal Reserve loaned $194 billion and $250 billion to domestic banks in the fourth and first quarter respectively through the new non-conventional lending facilities. Fed. Res. Banks took $159 billion of not elsewhere classified bank loans on their balance sheet in the first quarter of 2008, including $29 billion of Bear Stearns paper.

Now we know: n.e.c. and not investment grade!

red circles: decrease in net borrowing/net lending

green circles: increase in net borrowing/net lending

click to enlarge

source: Flow of Funds Accounts of the United States, First Quarter 2008

FEDERAL RESERVE statistical release, Z.1

http://www.federalreserve.gov/releases/z1/current/z1.pdf

Posted by

Fred

at

9:23 PM

0

comments

![]()

FedPres Lacker is a straight shooter - but lonely

Richmond Fed President Jeffrey Lacker delivers a straightforward warning to a London audience, and by doing so clearly dissents from the chief at the Federal Reserve. While Lacker has already dissented from lowering interest rates in the past this is the first open criticism of a laissez faire approach towards financial institutions practiced at the highest level. Bluntly, the Fed will have to let a big bank or investment house go under to prevent Wall Street from expecting a rescue operation every time it gets into trouble.

"The danger is that the effect of recent credit extension on the incentives of financial market participants might induce greater risk taking, which in turn could give rise to more frequent crises, in which case it might be difficult to further resist expanding the scope of central bank lending."

Now, Lacker thinks "the only credible way to limit expectations of future lending is to incur the risk of short-run disruptions to financial markets by disappointing expectations and by not lending as freely as before."

Posted by

Fred

at

3:22 PM

0

comments

![]()

MBA - Home foreclosures at record in first quarter of 2008

The MBA survey of delinquent mortgage loans on one-to-four-unit residential properties is at its highest level since 1979. Approximately 516,000 foreclosures that started during the first quarter and the percent of loans in the process of foreclosure are also the highest recorded since 1979.

The seasonally adjusted delinquency rate for mortgage loans on one-to-four-unit residential properties stood at 6.35 percent of all loans outstanding at the end of the first quarter of 2008 on a seasonally adjusted (SA) basis, up 53 basis points from the fourth quarter of 2007, and up 151 basis points from one year ago, according to MBA’s National Delinquency Survey.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process was 2.47 percent at the end of the first quarter, an increase of 43 basis points from the fourth quarter of 2007 and 119 basis points from one year ago.

The percent of loans on which foreclosure actions were started during the quarter was 0.99 percent on a seasonally adjusted basis, 16 basis points higher than the previous quarter and up 41 basis points from one year ago.

Certain loan types, like ARMs, are driving foreclosure start rates more than the decline in home prices according to the MBA. This is in contrast to augmented anecdotal evidence where negative LTVs are the primary cause for loan defaults.

Prime fixed rate loan foreclosure starts increased 7 basis points to 0.29 percent over the previous quarter and prime ARM foreclosure starts increased 49 basis points to 1.55 percent.

Subprime fixed foreclosure starts increased 28 basis points to 1.80 percent and subprime ARM foreclosure starts increased 106 basis points to 6.35 percent.

a small silver lining:

About 20 states had drops in their number of foreclosures started, including Michigan, Ohio and Indiana where problems have been the most severe for the last several years.

source: Delinquencies and Foreclosures Increase in Latest MBA National Delinquency Survey

Date: 6/5/2008

http://www.mortgagebankers.org/NewsandMedia/PressCenter/62936.htm

Posted by

Fred

at

1:50 PM

0

comments

![]()

ECB leaves rate unchanged at 4 percent in June 2008

The ECB left its key interest rates unchanged at 4 percent. In his introductory statement Jean-Claude Trichet, President of the ECB, reiterated his concern with a more protracted period of higher inflation. In the accompanying press conference he also said that the ECB could hike by a "small amount" at the July meeting in order to secure the solid anchoring of inflation expectations.

Looking ahead, on the basis of current futures prices for these commodities, the annual HICP inflation rate is likely to remain above 3% for some time to come, before moderating only gradually in 2009. We are thus currently experiencing a protracted period of high annual rates of inflation, which is likely to be more persistent than previously anticipated.

Consistent with this view, the Eurosystem staff projections foresee average annual HICP inflation at between 3.2% and 3.6% in 2008 and between 1.8% and 3.0% in 2009. Compared with the March 2008 ECB staff projections, the ranges projected for inflation in 2008 and 2009 are markedly higher, reflecting mainly higher oil and food prices and increasingly inflationary pressures in the services sector.

Securing a firm anchoring of medium and long-term inflation expectations in line with price stability is of the essence.

This passage included in the May08 statement was left out:

We believe that the current monetary policy stance will contribute to achieving our objective. We will continue to monitor very closely all developments over the coming weeks.

I found it also interesting that Trichet emphasizes that the projections of the Council are based on the assumption that oil and non oil commodity prices have basically topped out and will not move higher over the projected horizon. That is somewhat in contrast to Fed Pres Yellen and other rate setters who think that steady commodity prices, albeit at current high levels, will bring down inflation over the medium term. This is a serious problem of misinterpreting the current and present threat from inflation. Bernanke by emphasizing inflation and its link to the weak dollar is acknowledging some of the recent counterproductive developments in this sector. But talk is cheap and it remains to be seen if he can also walk the walk. Investors clearly appreciate a sound and consistent policy as seen in the 2 cents move higher of the euro against the dollar today.

click to enlarge

source: Introductory statement

Jean-Claude Trichet, President of the ECB,

Lucas Papademos, Vice President of the ECB

Frankfurt am Main, 5 June 2008

http://www.ecb.int/press/pressconf/2008/html/is080605.en.html

Posted by

Fred

at

11:38 AM

0

comments

![]()

Banks are borrowing from the Fed like its 1932

This two charts come from Jim Sinclair's excellent MineSet blog and are a riminder of how the current credit crisis compares to the 1930 depression era.

chart1 highlights the borrowed reserves as a percentage of total reserves at Federal Reserve Banks. Free reserves were at a depression level negative 77% last month.

chart2 shows the total borrowing in dollar terms of depository institutions from the Federal Reserve.

click to enlarge

Posted by

Fred

at

12:49 AM

0

comments

![]()