The credit crises train has long arrived at federal and private unsubsidized student loans. About 10 percent of lenders in the Federal Family Education Loan Program (FFELP) have limited or quit operation writes Anya Kamenetz, author of the book Generation Debt. There is no crises according to a spokesperson of Pennsylvania Higher Education Assistancy Agency. The Federal Government has an obligation to guarantee access to student loans. These loans should even come with lower interest rates because of legislation passed last year. Private student loans, which have no government guarantee and are dubbed subprime student loans, are a different story. Because of the credit crises it is more difficult to get them. It seems, that very much like in housing, securitization has also driven this corner of the market and like in housing we can expect further weakness. Education provider Apollo Group (APOL) reported a large earnings miss in its latest report. Student enrollment starts were up 6.2 percent, lower than estimate of 9.5 percent.

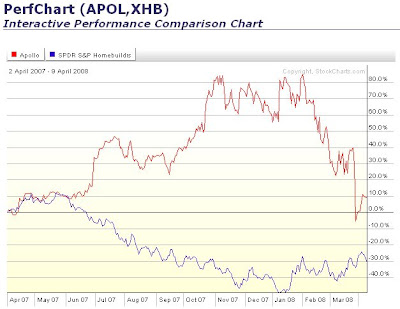

I took a closer look at the chart for XHB, the homebuilder ETF, and compared it to APOL, the education provider Apollo Group. I found it interesting that these two charts show a pattern of divergence in the second half of 2007. Since March 2008 APOL has fallen from a peak of 80% to now 10%. The SPDR S&P Homebuilders ETF is down 33%, the education provider Apollo Group, Inc. (NASDAQ:APOL) is up about 10% in the last 12 month.

update: Thu Apr 10th, 8:40am

Bloomberg reports today that no municipal bonds backed by action-rate student loans were sold in the first quarter. This is the first time in 40 years. FFELP funding accounted for 60 percent of the $78 bn loans made to students in 2007. The squeeze in the market has its roots in the collapse of the auction-rate bond market. Auction securities backed by student loans were about $86 bn of the $380 bn market. In addition to the collapse of the action-rate bond market, new rules from the overhaul of the subsidized federal student loan program is squeezing lenders even further.

source: There Is No Student Loan Credit Crunch

Anya Kamenetz

http://finance.yahoo.com/expert/article/generationdebt/75765

source: Auction Failures Force Students to Lose College Funds

Bloomberg

http://www.bloomberg.com/apps/news?pid=20602007&sid=aMEDmwGF8bQM&refer=rates

Wednesday, April 9, 2008

Does education service go the way of housing?

Posted by

Fred

at

9:46 PM

![]()

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment