Since the advanced numbers for first quarter GDP came in better than feared a heated debate is going on whether we are already in a recession or not. Martin Feldstein, head of the National Bureau of Economic Analysis (NBER), thinks that the U.S. economy is not in a recession yet. The forecasting value of NBER is challenging for two reasons. First, its analysis is quite often released well after the peak of economic activity and second, the frequent revisions to economic data make a timely forecast more difficult. In the 2001 recession economic activity peaked in March of 2001, the date of NBER's public release was eight month later in November 2001. NBER's delayed release takes 7 months to report peak activities and 16 months for troughs, on average. There is clearly a need for a more timely forecast of peak economic activities.

States should provide a useful link to national fluctuations in the business cycle because economic activity at the national level is simply the sum of economic activity (in dollar terms) of the component states. The Federal Reserve Bank of Philadelphia releases 50 state level coincident indexes which are released on a monthly basis. It also breaks out the nations diffusion index which is calculated as the percentage of state coincident indexes growing minus the percentage declining.

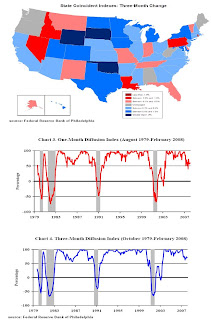

As talk of a recession has increased, data from the individual states are telling us another story: Although the nation is slowing, it is not showing a recession. The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for March 2008. The indexes increased in only 19 states for the month, decreased in 22, and were unchanged in the remaining nine (one-month diffusion index of -6). For the past three months, the indexes increased in 31 states, decreased in 14, and were unchanged in the other five (three-month diffusion index of 34).

click to enlarge

Contrary to common believe NBER does not use just movements in GDP for recession dating but defines a recession as follows:

“A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. A recession begins just after the economy reaches a peak of activity and ends as the economy reaches its trough.”

The four state-level variables in each coincident index are non-farm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). Frequent revisions to economic data are nevertheless challenging for both the coincident index and NBER's release.

While these revisions are often small, the most recent January BLS rebenchmark dramatically increased the level of the diffusion indexes in the fourth quarter. The December value was most affected. Pre-revision, the one-month diffusion index was -6 percent, but by February, it had been revised to 56 percent; the three-month diffusion index was less affected but still showed a sizable revision from 42 to 74 percent.

click to enlarge

source: State Coincident Indexes in March 2008

Federal Reserve Bank of Philadelphia

http://www.philadelphiafed.org/econ/indexes/coincident/2008/CoincidentIndexes0308.pdf

Tuesday, May 6, 2008

State level coincident indexes forecast no recession yet

Posted by

Fred

at

4:39 PM

![]()

Subscribe to:

Post Comments (Atom)

3 comments:

Fred,

Kudos.

Yours was one of the most insightful and educational commentaries I’ve seen yet.

In my view, we are not currently in a recession. And, I do not believe we will see one at any point in 2008.

I believe it is possible to use the very data cited by the NBER (combined with the current forecast from The Conference Board) to reach that conclusion:

================================

The Recession of 2008 That Wasn’t?

================================

P.S.) Not to nit pick, but you may want to correct the spelling of recession in the title of your post.

Thank you (for the spelling correction)! ;-)

Post a Comment