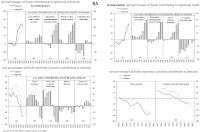

According to the latest bank lending survey in the Euro Area from July 2008 the net percentage of banks reporting a tightening of credit standards for loans to enterprises was 43% somewhat lower than 49% in the first quarter. The net tightening of credit standards continued to be stronger for large enterprises (44%, against 53% in the first quarter of 2008) than for small and medium-sized enterprises (SMEs; 34%, against 35% in the first quarter). The net demand for laons to enterprises continued to be negative in the second quarter at -16% against -17% in the first quarter. Loan demand was weaker for large firms at -12% vs -8% fro SMEs. The main factors in the negative net demand were M&As and corporate restructuring and a decline in financing needs for fixed investment. In addition, internal financing was another factor that contributed to lowering net demand for loans to enterprises, pointing to a robust profit situation of enterprises.

Tightening of credit standards for consumer credit increased somewhat to 24% in the second quarter from 19% in the previous quarter. Net demand for consumer credit decreased further to -21% from -13% in the previous quarter. Nevertheless, the level was considerably less negative than the level of net demand for loans for house purchase. The main factor dampening demand was a deterioration in consumer confidence according to reporting banks.

According to the latest Fed bank lending survey about 60% of domestic banks reported tighter lending standards on C&I loans to large and middle-market firms in the second quarter of 2008. About 65 percent of those institutions—up notably from roughly 50 percent in the April survey—also indicated that they had tightened their lending standards on C&I loans to small firms over the same period. About 80 percent of banks—up from roughly 70 percent in the April survey—noted that they had increased spreads of loan rates over their cost of funds on C&I loans to large and middle-market firms, and about 70 percent of respondents—a somewhat higher fraction than in the April survey—reported having widened spreads on loans to small firms. Loan demand for C&I loans weakened further in the July survey period. About 15 percent of small domestic and 25 percent of foreign banks reported weaker demand for C&I loans from firms of all sizes over the survey period.

About 65 percent of domestic banks—up notably from about 30 percent in the April survey— indicated that they had tightened their lending standards on credit card loans over the past three, months, and about the same fraction of respondents—up from roughly 45 percent in the April survey—reported having tightened standards on consumer loans other than credit card loans. Regarding loan demand, about 30 percent of respondents, on net, indicated that they had experienced weaker demand for consumer loans of all types over the past three months, up from about 20 percent in the April survey.

52 domestic banks and 21 U.S. branches and agencies of foreign banks contributed to this survey. The sample group of banks participating in the EA survey comprises 112 banks, representing all of the euro area countries, and takes into account the characteristics of their respective national banking structures.

click to enlarge

source: The July 2008 Senior Loan Officer Opinion Survey on Bank Lending Practices

Board of Governors Federal Reserve System http://www.federalreserve.gov/boarddocs/SnLoanSurvey/200808/fullreport.pdf

source: THE EURO AREA BANK LENDING SURVEY - JULY 2008 -

European Central Bank

http://www.ecb.int/stats/pdf/blssurvey_200807.pdf

Monday, August 11, 2008

Bank lending surveys reveal further tightening in lending standards

Posted by

Fred

at

10:44 PM

![]()

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment